Choosing the right mortgage lender can be difficult, especially for those navigating the housing market for the very first time.

In order to gauge how well-prepared borrowers are as they look for mortgages, the Consumer Financial Protection Bureau has conducted several lending surveys.

According to their data, first-time homebuyers, which account for 46% of America’s homebuyers, often forget to comparison shop.

In fact, the CFPB discovered that only 30% of the nation’s borrowers look at more than one lender when searching for a home loan.

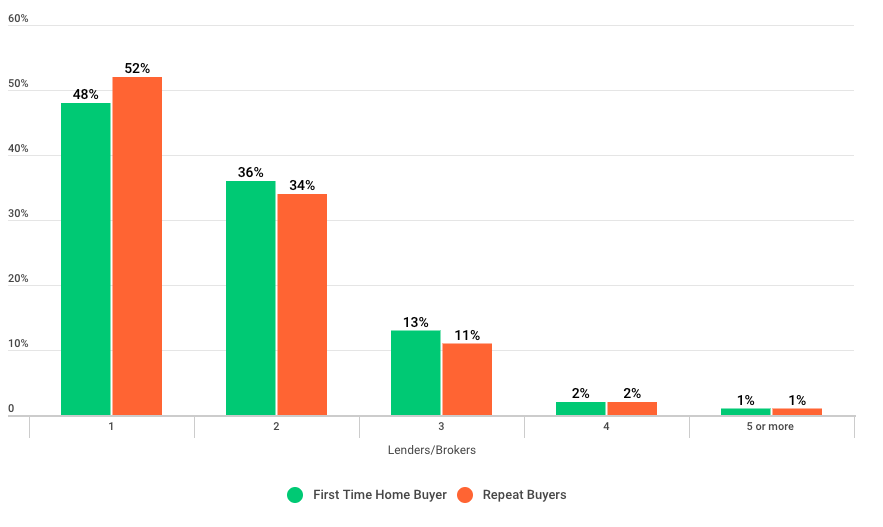

LendingTree, an online lending marketplace, recently released an analysis that compares the borrowing patterns of first-time buyers to repeat mortgage borrowers.

Their analysis, which is based on CFPB data, determined that 52% of first-time buyers considered more than one lender when choosing a mortgage. This is only slightly higher than the 48% of repeat borrows who do the same.

Additionally, the report highlights that just 29% of first-time buyers apply for a mortgage with more than one lender, compared with just 20% of repeat borrowers.

Unsurprisingly, 52% of repeat borrowers say they are very familiar with the different types of mortgages available, whereas just 24% of first-time homebuyers claim to be very familiar with the different types of mortgages available. That’s right, only 24%

These first-time buyers, who tend to fit in the Millennial category, are now projected to purchase at least 10 million homes in the next 10 years. In fact, by 2060, it is estimated that the generation will have produced more than 20 million first-time homebuyers.

As the generation takes to the market, learning how to mortgage shop will be essential to their perseverance as homeowners.

"In November 2018, Millennials finally overtook Generation X as having the largest share of new loans by dollar volume, with a share of 42% in December, compared to a share of 40% for Generation X and 17% for Baby Boomers,” Realtor.com wrote in a statement. “This indicates Millennials are willing to take on larger mortgages than any other generation to fulfill their dreams of homeownership.”

The image below shows the borrowing characteristics of both first-time buyers and repeat shoppers:

(Click to enlarge; courtesy of LendingTree)

Note: LendingTree’s mortgage shopping activity data was taken from the Consumer Financial Protection Bureau’s National Survey of Mortgage Originations which provides insights into borrowers’ experiences in getting a residential mortgage.