In the fourth quarter of 2018, the environment for apartment investment dampened following the highest increase of interest rates in nearly a decade, according to Freddie Mac’s latest Apartment Investment Market Index.

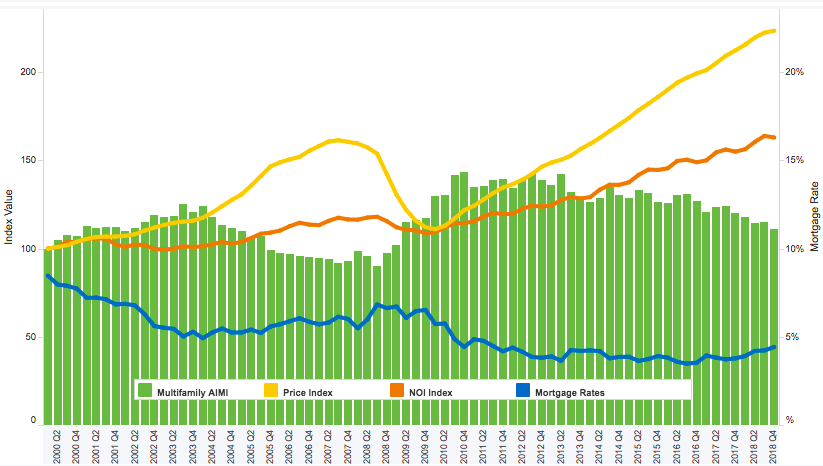

AIMI is an analytical tool that combines multifamily rental income growth, property price growth and mortgage rates. According to the report, the AIMI retreated 3% from the previous report, but declined more than 7% year over year.

“Interest rates were up 64 basis points in 2018, but net operating incomes generated by multifamily properties across most major markets in the U.S. continued to grow,” Freddie Mac Multifamily Research and Modeling Vice President Steve Guggenmos said. “The relatively tight supply of multifamily properties and strong demand for rental units has continued to buoy the market. Unsurprisingly, AIMI is impacted as rates rise, but the fundamentals remain quite healthy.”

According to Freddie Mac’s analysis, each housing market's AIMI experienced a decrease throughout the year, however every metro but Phoenix retreated in the fourth quarter of 2018.

Furthermore, 10 of the 13 housing markets measured by the index contracted in Q4, highlighting significant growth in net operating income throughout the year, according to the report.

“NOI growth over the past year was substantial,” Freddie Mac writes. “Every market and the nation experienced growth, and all but Houston outpaced their historical average growth rate. The nation grew at more than double the historical average annual rate."

The image below shows the change in AIMI year over year: