In the week following the largest one-week decline in a decade, mortgage interest rates remained virtually stagnant, according to the latest Freddie Mac Primary Mortgage Market Survey.

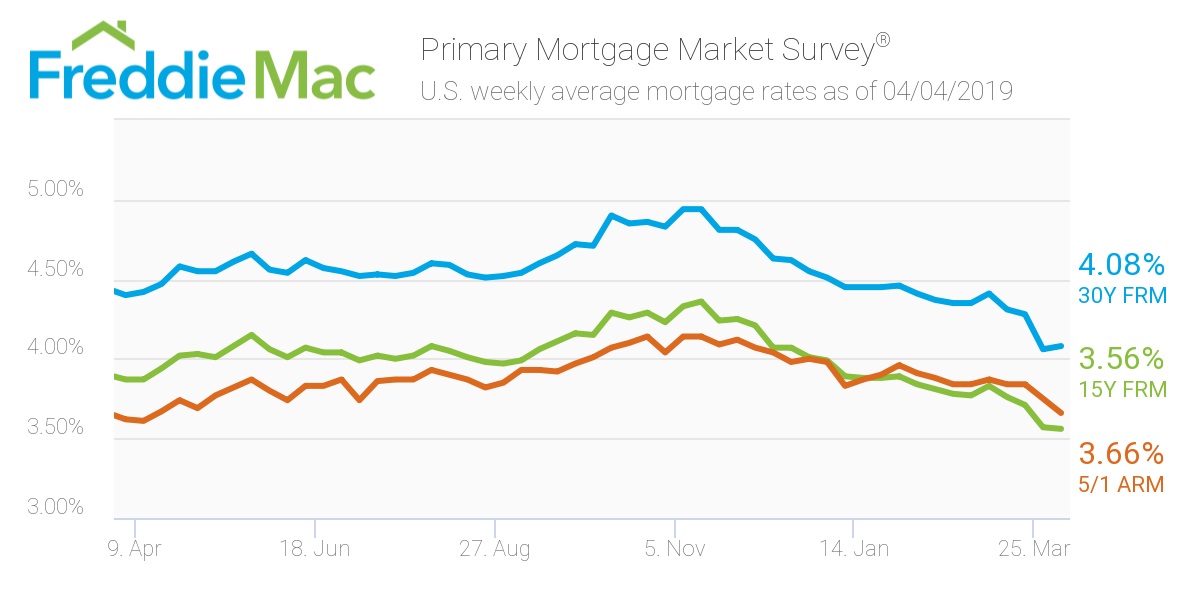

The 30-year fixed-rate mortgage averaged 4.08% for the week ending April 4, 2019, according to the survey, inching forward from last week's rate of 4.06%.

Notably, this week’s rate is much lower than last year’s rate of 4.4%.

Freddie Mac Chief Economist Sam Khater said purchase mortgage application demand saw the second highest weekly increase over the last year and thanks to a spike in refinancing activity, overall mortgage demand rose to the highest level since the fall of 2016.

“While the housing market has faced many head winds the last few months, it sailed through the turbulence to calmer seas with demand buttressed by a strong labor market and low mortgage rates,” Khater continued. “The benefits of the decline in mortgage rates that we’ve seen this year will continue to unfold over the next few months due to the lag from changes in mortgage rates to market sentiment and ultimately home sales.”

The 15-year FRM averaged 3.56% this week, slightly increasing from last week’s 3.57%. This time last year, the 15-year FRM was much higher coming in at 3.87%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.66%, edging down from last week’s rate of 3.75%. This rate remains moderately higher than the same time period in 2018, when it averaged 3.62%.

(Click to enlarge)