What so many in the housing industry have waited years for appears to be finally happening: Millennials are buying homes.

How much things can change in just a few months.

Back in September, after existing home sales fell to a three-year low, it appeared that many younger would-be buyers were turning to renting instead of buying.

But things look much different just a few months later.

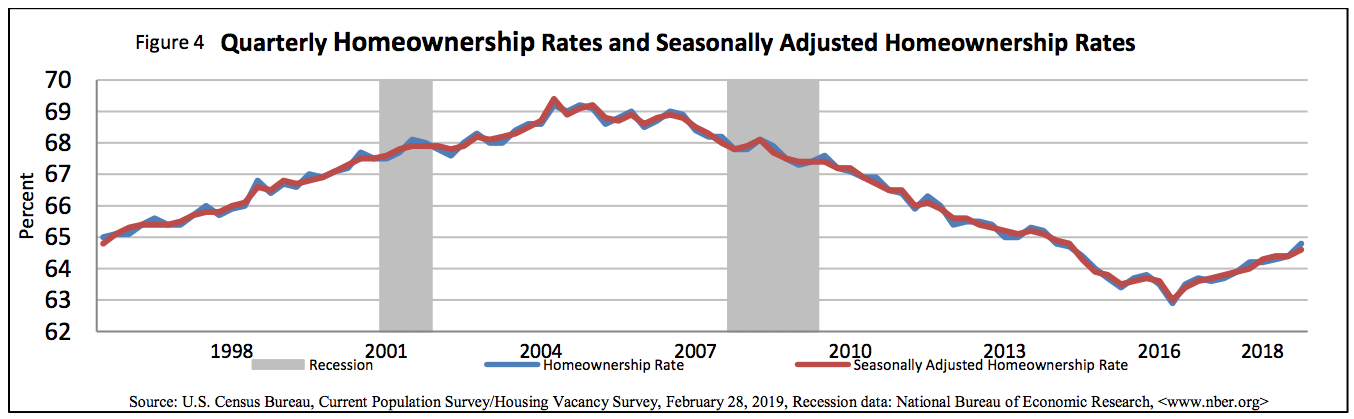

According to the latest data from the Census Bureau, the homeownership rate rose in the fourth quarter to 64.8%, which is a four-year high. And it also continues a trend of the homeownership rate steadily increasing ever since that figure hit a nearly all-time low back in 2016.

Ever since the homeownership rate hit 62.9% back in the second quarter of 2016, that figure has risen steadily, with the fourth quarter of 2018 hitting the highest total since the first quarter of 2014.

(Click to enlarge. Image courtesy of the Census Bureau.)

And just as in the third quarter, the increase is being driven by younger buyers, specifically those 44 and under.

And according to CoreLogic Deputy Chief Economist Ralph McLaughlin, there’s even more good news hidden in the data itself, as it appears that much of the growth in homeownership seems to be coming from renters who are becoming homebuyers.

“The fourth quarter of 2018 was the fifth consecutive quarter that owner-occupied households grew by more than a million, at 1.7 million new owner households,” McLaughlin wrote in a report. “At the same time, the number of new renter households fell six out of the past seven quarters with a decrease of 167,000 households. This suggests that the increase in the homeownership rates is at least partly due to households making a switch from renting to owning.”

Beyond that, McLaughlin said, total household growth has pushed past 1% for five straight quarters, which is “positive news for the housing industry at large.”

According to McLaughlin, this streak represents the longest and largest magnitude of household growth in more than 12 years.

As McLaughlin notes, homeownership among buyers age 35 and under rose from 36% to 36.5% in the last year, while homeownership for those from age 35-44 rose from 58.9% to 61.1% in the same time frame.

And with the oldest Millennials checking in at somewhere between 36 and 39 (depending on which data source you believe on when the Millennial generation actually begins), homeownership among older Millennials definitely appears to be a thing.

“American households, especially young households, are becoming confident enough in their financial and familial circumstances to take the plunge into homeownership, despite rocky outcrops of affordability and sparse inventory,” McLaughlin said.

“This is good news for proponents of homeownership in the United States since young households represent the largest pool of potential homebuyers since their parents, the baby boomers, came of homebuying age over three decades ago,” he added.

McLaughlin said that the data shows that the housing market is continuing on a healthy path of recovery from the housing crisis.

“This is for three reasons: first, the upward tick in homeownership has been stubbornly persistent, despite the existence of low housing affordability and inventory; next, household formation has seen the strongest streak in over a decade; and lastly, young households, which represent the largest pool of potential homebuyers in the United States, are starting to enter the homeownership game,” McLaughlin said. “The future of homeownership in this country indeed looks bright.”