Gross domestic product was supported by consumer and federal spending in the fourth quarter of 2018, according to the initial estimate from the Bureau of Economic Analysis.

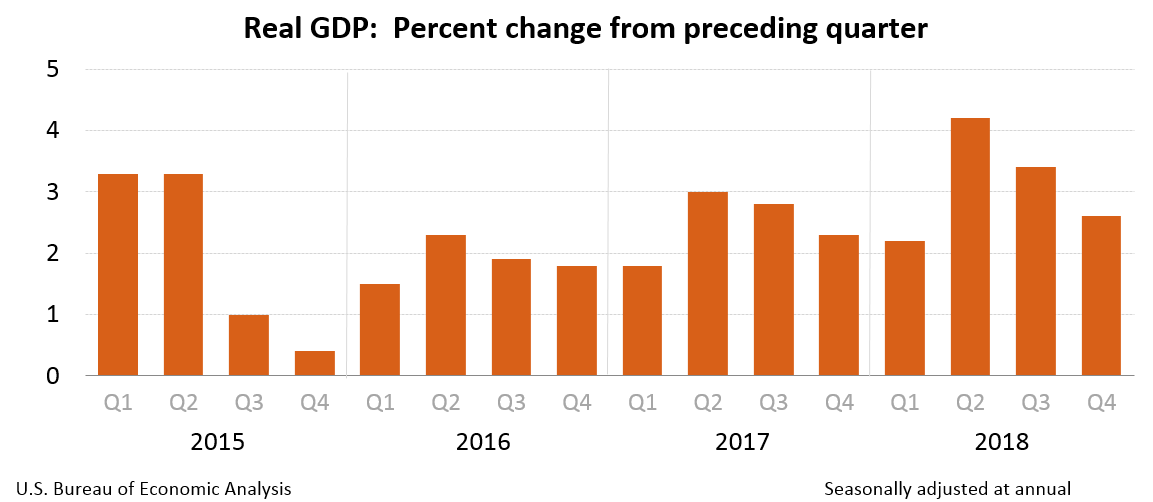

Real GDP increased to an annual rate of 2.6% in the fourth quarter, according to the initial estimate. This is moderately down slightly from the 3.4% growth seen in the third quarter.

During 2018, real GDP increased 3.1%, up from 2.5% during 2017. Notably, the price index for gross domestic purchases increased 2.1% during 2018, moderately higher than 1.9% throughout 2017.

Today’s fourth-quarter initial estimate is a result of the partial government shutdown and replaces the bureau’s advance estimate and second estimate scheduled January 30 and February 28, respectively.

The chart below shows that GDP fell nearly one percentage point from the third quarter and is slightly up from the fourth quarter of 2017.

(Click to enlarge; courtesy of BEA)

The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures, non-residential fixed investment, exports, private inventory investment and federal government spending.

These were partly offset by negative contributions from residential fixed investment and state and local government spending. Notably, imports increased in percentage.

The deceleration in real GDP growth in Q4 reflected slowdowns in private PCE, inventory investment and federal government spending and a downturn in state and local government spending. These movements were partly offset by an uptick in exports and an acceleration in non-residential fixed investment.

Current-dollar GDP increased 4.6%, or $233.2 billion, in the fourth quarter to a level of $20.89 trillion. This is down from the third quarter’s 4.9%, or $246.3 billion.

However, Current-dollar GDP increased 5.2%, or $1.02 trillion, in 2018 to a level of $20.5 trillion, climbing from 4.2%, or $778.2 billion in 2017.

The gross domestic price purchase index increased 1.6% in the fourth quarter, down from an increase of 1.8% in the third quarter. Personal consumption expenditures increased 1.5%, down from 1.6% last quarter.

Navy Federal Credit Union Corporate Economist Robert Frick said at a 2.6% gain, fourth quarter GDP was a welcome upside surprise, and further cast doubt on the veracity of the weak December retail numbers.

“While the economy is slowing, perhaps to a plateau of about 2% over this year, that's plenty of economic heat to keep jobs increasing at a strong pace, and to keep wages rising,” Frick continued. “As long as jobs and wages are in good shape, consumer spending will remain healthy, further contributing to GDP in a virtuous cycle.”