Freddie Mac made more money last year than it did in 2017, but that growth didn’t come from the multifamily side of the business, despite the government-sponsored enterprise having a record year for multifamily.

Freddie Mac reported its fourth-quarter and full-year 2018 earnings early Thursday morning, and those earnings showed that the GSE’s full-year income was $8.4 billion in 2018, an increase of approximately 4% from 2017.

The increase would have been even greater if it hadn’t been for the multifamily business.

A deeper look into Freddie Mac’s earnings shows that the GSE made $1.236 billion from the multifamily business in 2018, but that figure is down more than $700 million from the year before.

By comparison, in 2017, Freddie Mac made $1.937 billion from its multifamily business.

The decrease is surprising considering that Freddie Mac recently reported that it hit all-time highs in both multifamily security issuance and total multifamily production last year.

According to the GSE, its multifamily production was $78 billion in 2018, beating its previous record of $73.2 billion, set in 2017.

So what caused the dip in income in spite of the increase in business? Freddie Mac explains:

Comprehensive income decreased $0.7 billion from the full-year 2017 primarily driven by spread widening during 2018 which resulted in fair value losses on mortgage loans and commitments and mortgage-related securities.

Other than that, it was a banner year for Freddie’s multifamily business.

“New business activity was a record $78 billion for the full-year 2018, an increase of approximately 7% from the full-year 2017, while outstanding purchase commitments increased 29% to nearly $19 billion, primarily reflecting continued strong demand for multifamily loan products and continued competitive pricing efforts,” the GSE said in its earnings release.

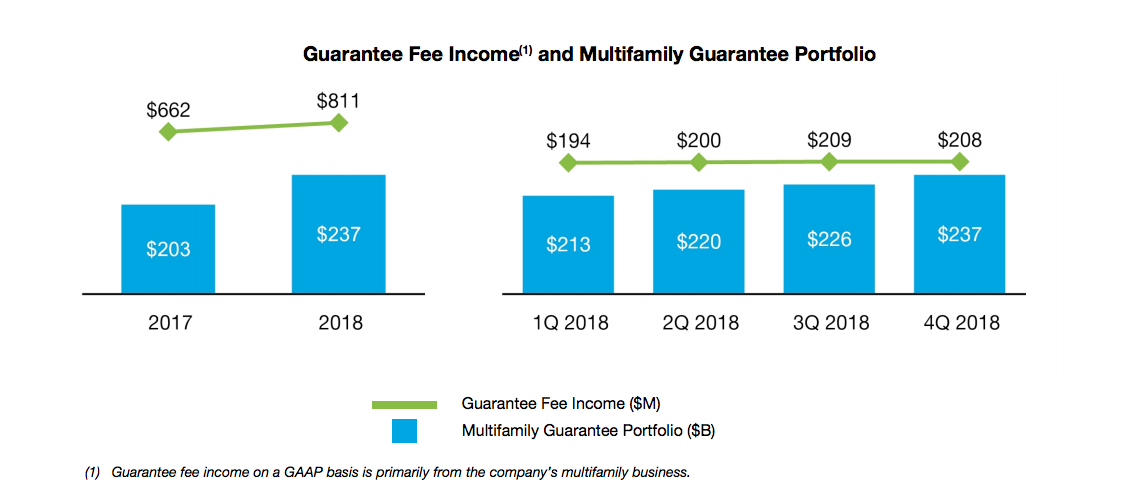

The GSE’s multifamily portfolio also continued to increase, continuing a trend stretching back several quarters.

According to the GSE, its multifamily guarantee portfolio increased 17% in 2018 over 2017 to $237 billion.

More than a year ago, Freddie Mac’s multifamily guarantee portfolio was $184 billion. Since then, it has risen to $203 billion in the fourth quarter of 2017, to $213 billion in the first quarter of 2018, to $220 billion in the second quarter, then to $226 billion in the third quarter, and finally to $237 billion at the end of the year.

(Click to enlarge. Image courtesy of Freddie Mac)

Following the same trend, the GSE has increasingly financed more multifamily rental units over the last five years.

In 2014, Freddie Mac financed approximately 413,000 units. That figure rose to 650,000 in 2015, then to 739,000 units in 2016, then to 820,000 units in 2017, and finally to 866,000 last year.