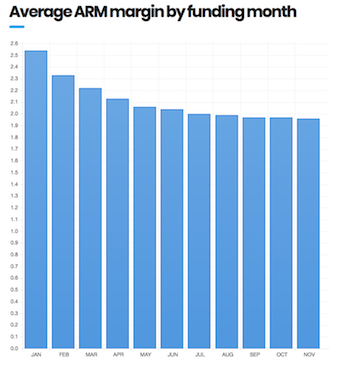

Margins on adjustable-rate reverse mortgage loans averaged 1.96% in November, according to Baseline Reverse’s latest Margin Report.

This is down slightly from previous months, as October had an average of 1.98%, September totaled 1.97% and August leveled off at 1.99%. (Click chart below to enlarge.)

But the variation is only slight, indicating a stable margin rate that suggests lenders have found their competitive footing after program changes issued in October 2017 sparked a jump in margins as players looked to regain profitability.

But the variation is only slight, indicating a stable margin rate that suggests lenders have found their competitive footing after program changes issued in October 2017 sparked a jump in margins as players looked to regain profitability.

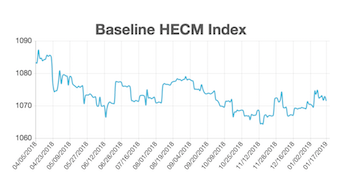

But while margins appear to have changed little month over month, the HECM index, which measures bond pricing for a basket of 2017 PLF Annual LIBOR loans, reflected a more notable change, rising from October’s 1066.91 to 1072.27 at the end of November.

Baseline President Dan Ribler said this is good news for investors.

“The index improved through November as the forward rate curve flattened as rates fell,” Ribler said. “A flatter rate curve is generally good for HECM ARM pricing, as higher initial rates (driven by the front of the curve/current LIBOR rates) can be offered at the same expected rate (driven by the back end of the curve/10-year swap rate).”

(Click chart below to enlarge.)