Senior homeowners continue to amass record amounts of home equity.

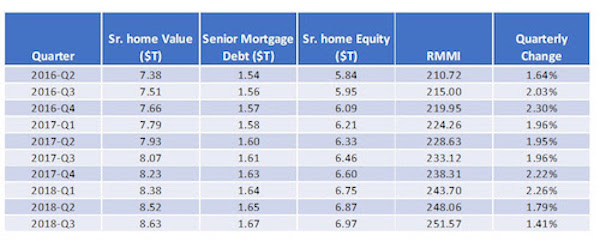

An index tracking home equity levels for homeowners 62 and older by the National Reverse Mortgage Lenders Association and RiskSpan reveals that housing wealth for this group grew 1.4% to $6.97 trillion in the third quarter of 2018.

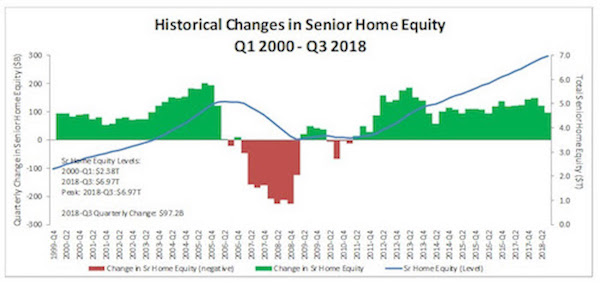

The Reverse Mortgage Market Index rose to 251.57 in Q3, which is $97 billion more than Q2 and the highest amount on record since the index began in 2000.

NRMLA attributed the increase to a 1.3% bump in senior home values, which was offset by a 1.1% increase in senior-held mortgage debt.

“At a time when we’re seeing stock market volatility and the potential for a mild recession in the near future, it’s the perfect time for families to gather and take stock of their retirement resources and make necessary adjustments to ensure continued financial security,” said NRMLA President and CEO Peter Bell. “Housing wealth should be considered with other financial assets.”

See below for a historical look at senior home equity levels.