Although many Americans struggle to navigate the housing market's ups and downs, data suggests the path to homeownership for self-employed borrowers is especially difficult.

In a recently issued report, titled "The Continued Impact of the Housing Crisis on Self-Employed Households,” Urban Institute utilizes data from the American Community Survey to highlight the disparities self-employed borrowers face in comparison to salaried households.

“There is wide recognition that self-employed people find it more difficult to get approved for a mortgage than people who receive a regular paycheck,” Urban Institute writes. "The self-employed can be more difficult to underwrite in part because they, unlike salaried workers, experience greater income volatility and lack pay stubs or W-2 wage statements that make it easy for lenders to verify and document income.”

That being said, self-employed households statistically have higher median incomes than salaried households. However, they have also been slower at recovering from the recession.

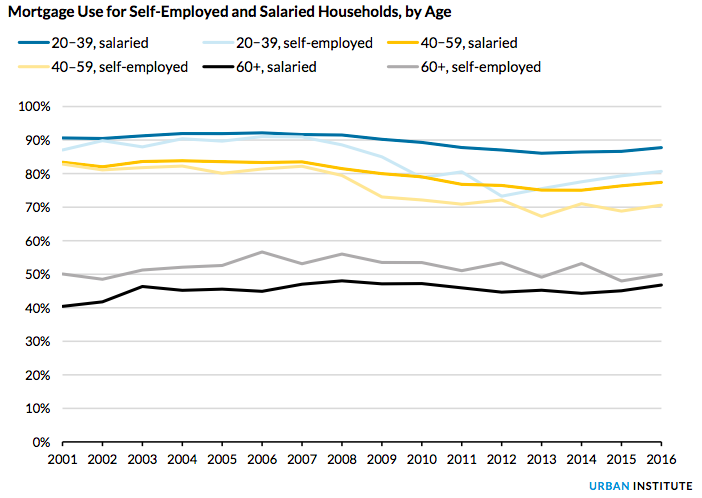

“Incomes, mortgage use, and the homeownership rate for both household types declined during the recession, but self-employed households lost more ground,” Urban Institute explains. “Most strikingly, even when income is held constant, mortgage use and the homeownership rate for self-employed households fell more than they did for salaried households, suggesting that other factors, such as reduced credit availability, are likely at play.”

In 2016, around 12% of U.S. households earned at least a portion of their income from self-employment, accounting for nearly one-tenth of U.S. households. During this time, the homeownership rate and mortgage use among self-employed households declined 13 percentage points compared with 6 percentage points for salaried households, according to the report.

Notably, those aged from 20-to-39 were hit the hardest. In fact, mortgage use for young self-employed Millennial households fell to 80.6%, while mortgage use for salaried households fell to 87.7%.

(Click to enlarge)

This is worrisome as calculations from the U.S. Census Bureau and First American, indicate that Millennials are now expected to purchase at least 10 million new homes over the next 10 years. These Millennials, who are often weighed down by student loan debt, will more than likely need mortgages to make their homeownership dreams a reality.

Unfortunately, when compared to every age group, Urban Institute states that self-employed households of prime homebuying age, are the ones whose likelihood of having a mortgage have fallen the most since the housing crisis.