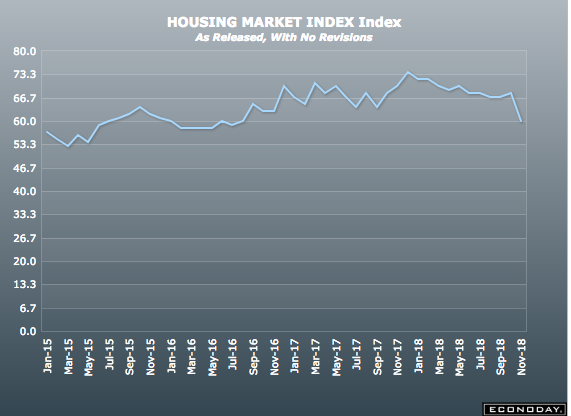

Persistent affordability concerns contributed to homebuilder confidence retreating four points to 56 in December, according to the National Association of Home Builders/Wells Fargo Housing Market Index.

December's reading is the lowest HMI score since May 2015, marking a three-year low. Despite this, NAHB claims builder sentiment remains in positive territory.

“We are hearing from builders that consumer demand exists, but that customers are hesitating to make a purchase because of rising home costs,” NAHB Chairman Randy Noel said. “However, recent declines in mortgage interest rates should help move the market forward in early 2019.”

NAHB Chief Economist Robert Dietz said the fact that builder confidence dropped significantly in areas of the country with high home prices shows how the growing housing affordability crisis is hurting the market.

“This housing slowdown is an early indicator of economic softening, and it is important that builders manage supply-side costs to keep home prices competitive for buyers at different price points,” Dietz said.

In December, the index measuring current sales conditions declined from 67 to 61 points, while buyer traffic decreased from 45 to 43. Lastly, expectations over the next six months slid from 65 to 61 points.

The three-month moving averages for regional HMI scores show the Northeast plummeted eight points from 58 to 50 points, the West and South both decreased three points to 68 and 65, respectively. Notably, the Midwest fell two points from 57 to 55 points.

(Click to enlarge)

NOTE: The NAHB/Wells Fargo Housing Market Index gauges builder opinions of single-family home sales and expectations, asking for a rating of good, fair or poor. Builders are also asked to rate prospective buyer traffic from very low to very high. The scores are used to calculate a seasonally adjusted index with a rating of 50 or over indicating positive sentiment.