A new study from the Urban Institute shows key policies and their results that Americans should consider before voting on Election Day 2018.

The study examines three different programs including the Temporary Assistance for Needy Families, the Supplemental Nutrition Assistance Program and public health insurance.

The study found that, overall, these programs reduce the number of hardships that low-income families with children experience by 48%. It also found it reduces their food insufficiency by 72%.

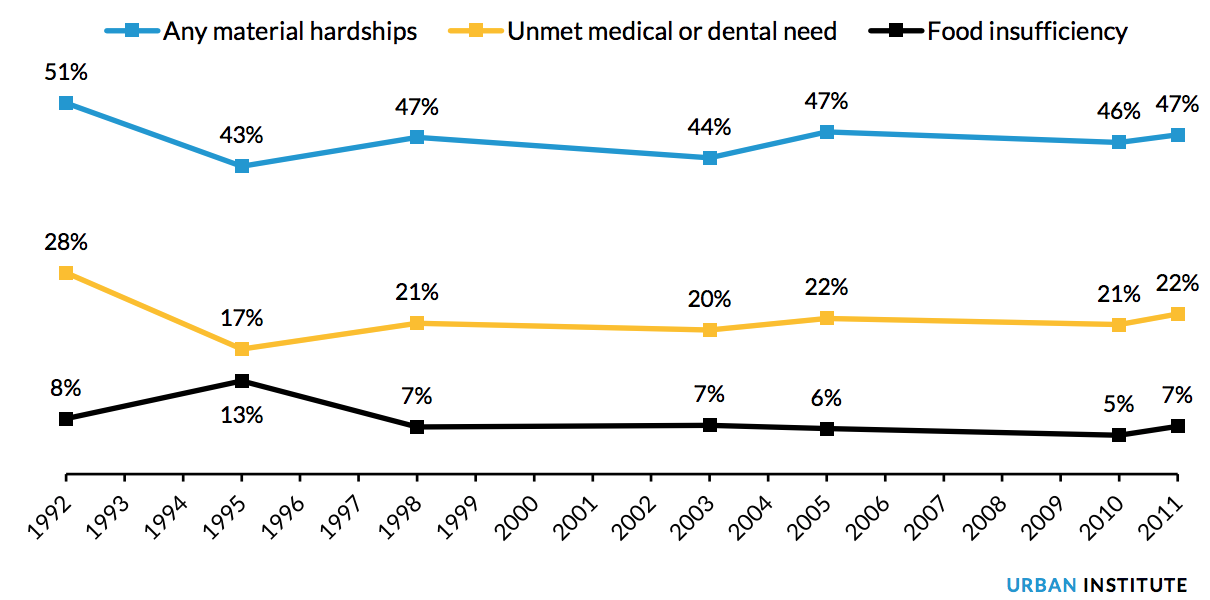

Food insufficiency measures whether people had to cut back their food consumption because of a lack of money in the past four months. Unmet medical or dental need measures whether people needed to go to the doctor or dentist but could not afford to in the past 12 months. Number of hardships includes any general report of not meeting essential expenses, inability to pay rent or mortgage, eviction, unpaid utility bills, utility service cut, phone service cut, unmet medical or dental need and food insufficiency.

The study explained that the significant reduction in hardships seen in those who utilize the program shows the risk of cutting these safety net programs. The study explained it could create an increase in evictions as families find themselves unable to make their mortgage or rent payments.

The chart below shows how many low-income families experienced material hardships from 1992 to 2011.

Click to Enlarge

(Source: Urban Institute)

The Urban Institute said its study also found that a $1 increase in the minimum wage, but not the earned income tax credit, reduces material hardship by 4% to 6% among low-income families with children.

“Our evidence that the safety net’s TANF, SNAP, and public health insurance programs reduced material hardship for low-income families with children by 48% over the past quarter century suggests that the basic needs of families would be at risk should these safety net programs be cut,” the Urban Institute said in its report.

“Safety net programs are not just good for families in tough times; they can also be good for the economy,” the report continued. “When program spending increases during a recession and puts money in the hands of low-income families (as well-targeted, automatically stabilizing safety net programs should), people with low incomes are more likely to spend money and stimulate the economy.”