The multifamily gravy train kept rolling for Freddie Mac in the third quarter, with the government-sponsored enterprise continuing to increase its originations and overall portfolio.

Freddie Mac reported Wednesday that its third-quarter multifamily originations increased by 2% over last year to $47 billion. Additionally, Freddie’s multifamily guarantee portfolio increased 3% from the prior quarter to $226 billion.

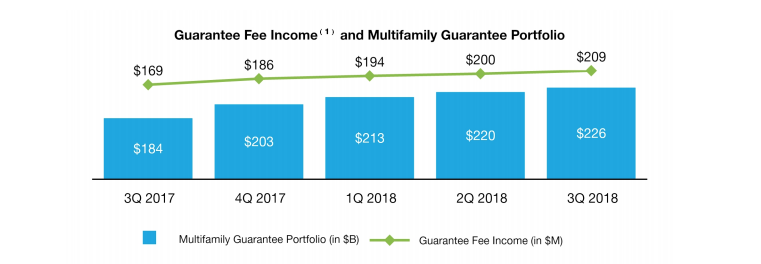

That continues an upward trend for Freddie Mac’s multifamily business, which has grown steadily over the last several quarters.

One year ago, Freddie Mac’s multifamily guarantee portfolio was $184 billion. Since then, it has risen to $203 billion in the fourth quarter of 2017, to $213 billion in the first quarter of this year, to $220 billion in the second quarter, and now to $226 billion.

(Click to enlarge. Image courtesy of Freddie Mac)

That’s an increase of nearly 23% in one year.

According to Freddie Mac, the growth is “primarily due to our strong new loan purchase and securitization activity, which is attributable to healthy multifamily market fundamentals and a strong demand for certain of our securitization products.”

The GSE also said that it expects to continuing growing its portfolio as purchase and securitization activities should outpace run-off.

“The combination of our new business activity and outstanding purchase commitments was higher for the 2018 periods than the 2017 periods due to continued strong demand for multifamily loan products and our strategic pricing efforts,” the GSE added.

Freddie Mac said that its new purchase volume was nearly $18 billion for the third quarter of 2018, an increase of 13% from the prior quarter, while its outstanding purchase commitments rose 16% to $24 billion.

According to Freddie Mac, the GSE provided financing for approximately 209,000 rental units in the third quarter of 2018. Of those, 94% of the eligible units financed in the third quarter of 2018 were affordable to families earning at or below 120% of area median incomes. Additionally, 87% of the eligible units financed in the third quarter of 2018 were affordable to families earning at or below 100% of area median incomes.

Overall, the GSE’s total number of rental units financed is running ahead of last year. According to the GSE, it has financed approximately 551,000 rental units so far this year. During the same first three quarters of last year, Freddie financed 530,000 rental units.