Multifamily lenders saw a great year in 2017, seeing an all-new record high for the year, according to a new study from the Mortgage Bankers Association.

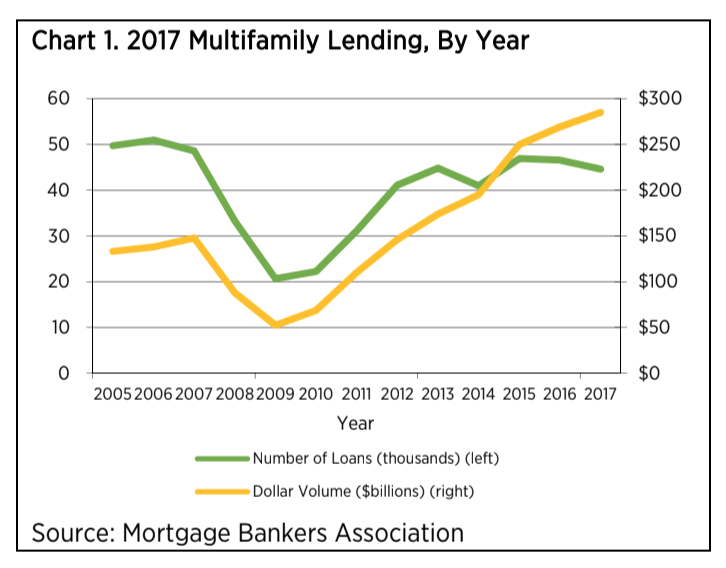

Strong market conditions fueled a 6% increase in multifamily lending last year to $285 billion in new mortgages for apartment buildings with five or more units, according to the annual report.

While the number of loans originated remains relatively steady, the chart below shows the loan amounts are rising as the total loan volume continues to rise.

Click to Enlarge

(Source: MBA)

“The multifamily lending market in 2017 benefited from improving fundamentals, rising property values and low interest rates,” said Jamie Woodwell, MBA vice president of commercial real estate research. “The result was larger loan sizes and record levels of overall borrowing and lending.”

“The market remains well served, with 2,554 lenders last year making loans backed by multifamily rental properties,” Woodwell said. “Demand came from borrowers and lenders of all sizes, with loan amounts ranging from thousands of dollars to hundreds of millions.”

While 58% of active lenders made five or fewer multifamily loans in 2017, some lenders stood out above the rest. Here are the top five by dollar volume:

5. Berkadia

The company closed 807 loans for a total of $15.56 billion and had an average loan size of $19.3 million.

4. Walker & Dunlop

The company closed 783 loans for a total of $17.58 billion and had an average loan size of $22.5 million.

3. JPMorgan Chase

The company closed 5,576 loans for a total of $17.66 billion and had an average loan size of $3.2 million.

2. CBRE Capital Markets

The company closed 1,135 loans for a total of $17.67 billion and had an average loan size of $15.6 million.

1. Wells Fargo

The company closed 1,350 loans for a total of $20.81 billion and had an average loan size of $15.4 million.

When arranged by number of loans, JPMorgan came out on top with 5,576 multifamily loans, followed by Wells Fargo with 1,350 loans and CBRE Capital Markets with 1,135 loans.

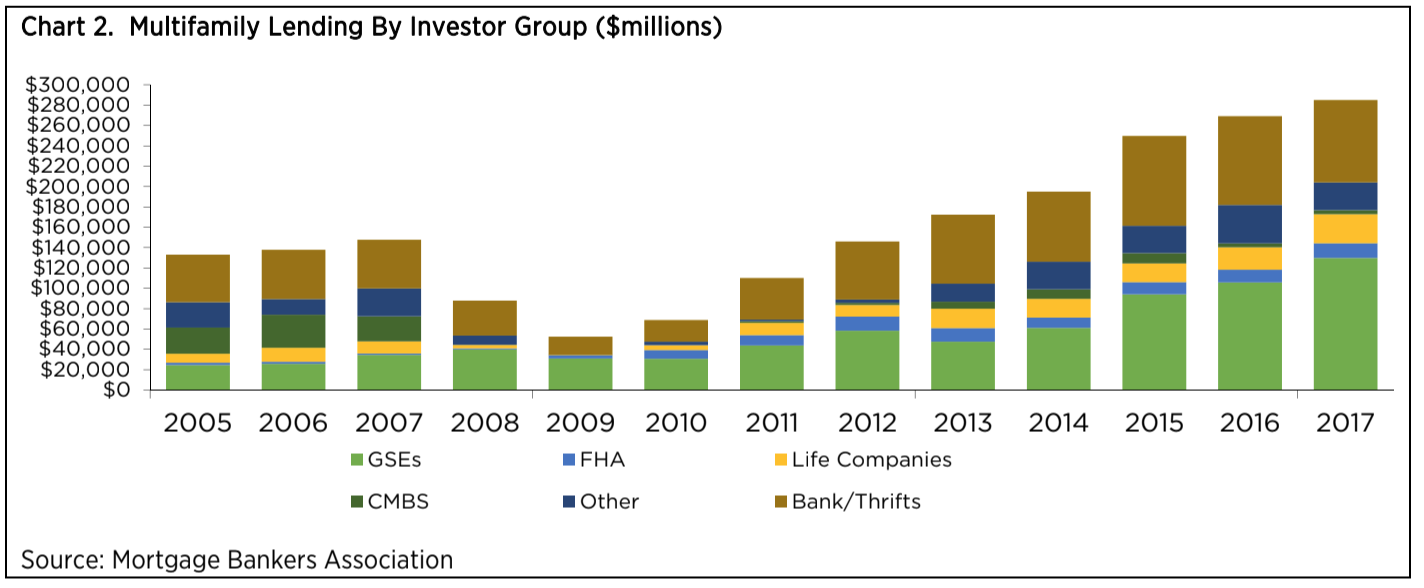

The $285 billion in mortgages were funded by several different capital sources, but by dollar volume, the highest by-far was the Government-Sponsored Enterprises. Fannie Mae and Freddie Mac funded 46% of multifamily originations in 2017.

The chart below shows the distribution of multifamily lending by investor group. Banks and thrifts followed the GSEs as the second highest capital source for multifamily loans.

Click to Enlarge

(Source: MBA)