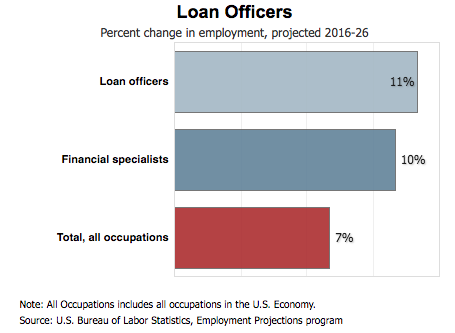

The employment of loan officers is expected to grow 11% from 2016 to 2026, faster than the average for all occupations. Probably the reason why we have a separate newsletter dedicated to our lending friends.

As the economy grows the demand for loan officers’ increases, and the Bureau of Labor Statistics also tells us the decline of bank branches may moderate employment growth. Not only is the demand high but loan officers are also ranked No. 57 on the 100 Best Jobs in 2018.

The market welcomes new loan officers with open arms. LO’s typically need a bachelor’s degree in either business or finance but some experienced jobseekers may be able to enter the profession without a degree.

As of May of 2017, the average annual wage for loan officers is $64,660. However, this number varies from state to state. A study from Zippia shows the top five average annual salaries for loan officers by state:

- Kansas: $92,391

- Texas: $90,782

- Nebraska: $85,131

- Florida: $84,221

- Missouri: $83,550

If you are interested in a career as a loan officer, check out our latest openings at Collins Home Mortgage.

Collins Home Mortgage is located in Vero Beach, Florida, No.4 on the list above, and has openings throughout the state.

The company is looking for loan officers with a minimum of two years of experience and an established group of business referral sources.

Apply here and don’t miss another job opportunity at jobs.housingwire.com.

[Disclosure: Collins Home Mortgage is affiliated with the publisher of HousingWire.]