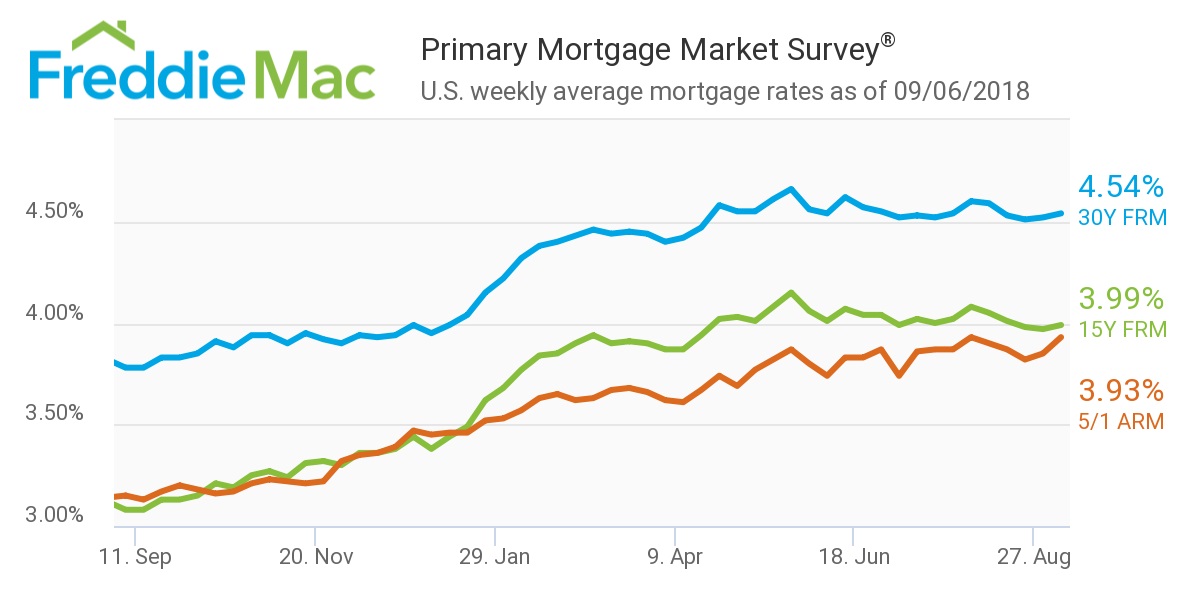

Mortgage rates continue to slightly increase, according to Freddie Mac’s latest Primary Mortgage Market survey.

Freddie Mac Chief Economist Sam Khater said the 30-year fixed-rate mortgage inched higher for the second consecutive week.

According to the Primary Mortgage Market survey, the 30-year fixed-rate mortgage averaged 4.54% for the week ending Sept. 6, 2018, increasing from 4.21% last week, and is still a significant increase from last year’s rate of 3.78%.

“Borrowing costs may be slowly on the rise again in coming weeks, as investors remain optimistic about the underlying strength of the economy,” Khater said. “It’s important to note that rates are now up three-quarters of a percentage point from last year and home prices – albeit at a slower pace – are still outrunning rising inflation and incomes.”

The U.S. Bureau of Economic Analysis revealed real gross domestic income growth slowed, increasing only 1.8% in the second quarter, down from an increase of 3.9% in the first quarter of 2018.

(Source: Freddie Mac)

The 15-year FRM averaged 3.99% this week, climbing from last week's 3.97%. This time last year, the 15-year FRM was 3.08%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged this week at 3.93%, up from 3.85% last week, and is still up from this time last year when it was 3.15%.

“This weakening in affordability is hindering many interested buyers this fall, even as the robust economy brings them into the market,” Khater added. “The good news is that purchase mortgage applications have recently rebounded to above year ago levels.”