Private mortgage insurance continues to surge, seeing a significant increase in new mortgage insurance written in the second quarter.

New business volume rose to about $80.3 billion in NIW in the second quarter of 2018, up a full 14% from the second quarter of 2017, according to a report from Moody’s Investor Services. Private mortgage insurance totaled $138.8 billion in the first half of 2018, also up 14% from last year.

This represents the first time quarterly new business production has passed $80 billion since 2016, meaning the second quarter of 2018 hit a new post-crisis peak, according to the report.

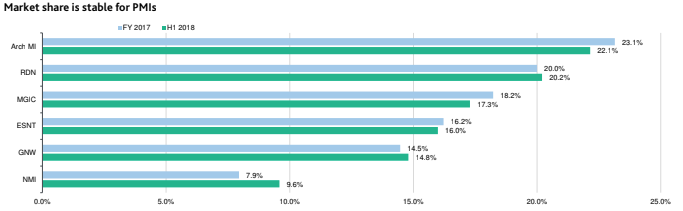

The chart below shows the market share remains stable for private mortgage insurers, and many saw an increase from the first half of 2017 to the first half of 2018.

Click to Enlarge

(Source: Moody’s)

“The PMIs reported strong results in the second quarter of 2018, reflecting growth in new production, earned premiums from high-quality recent vintage business and lower incurred losses,” Moody’s stated. “Although mortgage rates have begun trending higher and housing affordability lower, we believe credit fundamentals will remain positive for the sector, and likely drive healthy performance through the second half of the year.”

This year, MI companies upped their game, growing more competitive against the Federal Housing Administration with cuts to their mortgage insurance premiums. In fact, an analysis from the Urban Institute suggests private mortgage insurance is growing more competitive against the FHA.

Most new MI costs became effective in June of this year.

During the second quarter, mortgage insurance companies reported a surge in their earnings with increases to net income and new insurance written.

Moody’s explained that by reducing their costs, mortgage insurance companies wiped out their gains from the recently passed tax cuts.

“Given the current high persistency rates and expected ordinary loan amortization profiles, we do not expect the new lower premium rate business to become a majority of in-force business for several years,” the company stated.

And despite the increase in the first half of 2018, the report explained private mortgage insurance could soon face headwinds. Currently, rising economic growth, higher home prices and low unemployment are favorable for mortgage credit and PMIs. However, higher mortgage rates and decreasing affordability create potential challenges to future business.

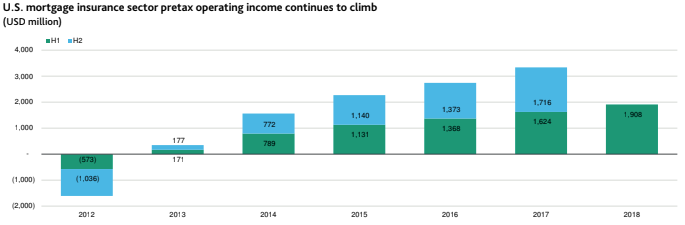

But the profitability of mortgage insurance has continued to increase since early 2013 as lower quality pre-crisis loans fall off and are replaced by higher quality loans, the report explains.

The chart below shows pretax operating income for private mortgage insurance companies continues to increase each year, with 2018’s $1.9 billion income in the first half of the year far surpassing to loss of $573 million in the first half of 2012.

Click to Enlarge

(Source: Moody’s)

“As a result of the shifting composition of insurance-in-force, PMIs are experiencing low new default rates and lower losses incurred, with most of the losses coming from pre-crisis loans that remain on the books of legacy companies,” Moody’s stated in the report. “There was also a significant increase in cures of hurricane-related defaults since the end of 2017. We expect default rates to continue to decline at a steady pace as pre-2009 vintage loans run off.”