The Home Affordable Refinance Program continues to shrink, making up just 1% of total refinance volume in the second quarter, according to the Q2 2018 Refinance Report from the Federal Housing Finance Agency.

HARP was established in 2009 to assist homeowners unable to access a refinance due to a decline in their home value. Since its inception, HARP has been extended several times, and is now set to expire December 31, 2018.

Borrowers completed 2,973 refinances through HARP in the second quarter, bringing the program's total refis since inception to nearly 3.5 million.

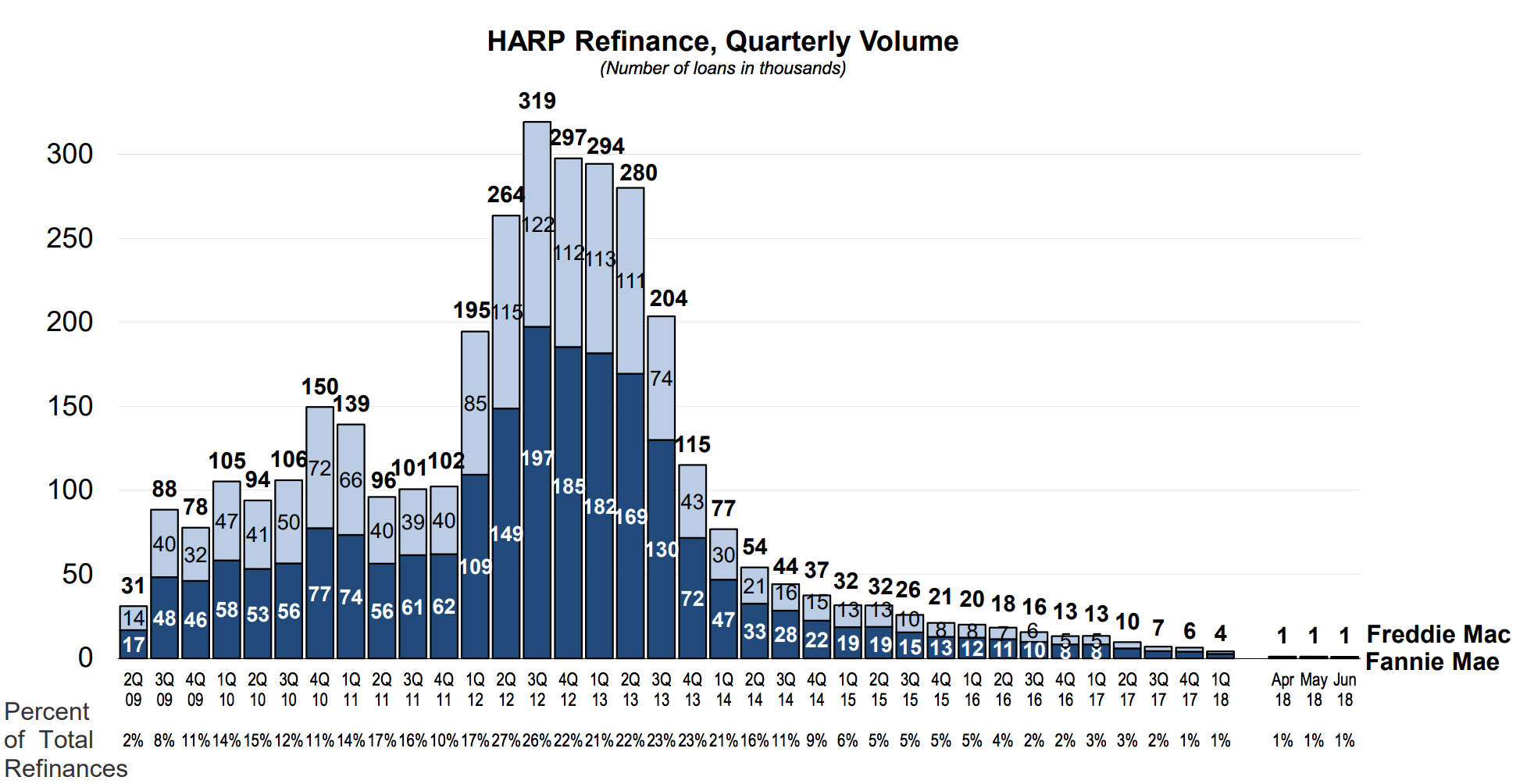

The chart below shows HARP refis have continued to fall since hitting a peak in the third quarter of 2012. During the first quarter this year, HARP refis made up 4% of refinance volume, falling to just 1% in all three months of the second quarter.

Click to Enlarge

(Source: FHFA)

And HARP refis aren’t the only refinances seeing a decline. While HARP is losing market share, rising interest rates continue to chip away at refinance demand, according to the latest data from Ellie Mae. In fact, purchase loans now make up about 75% of the market share.

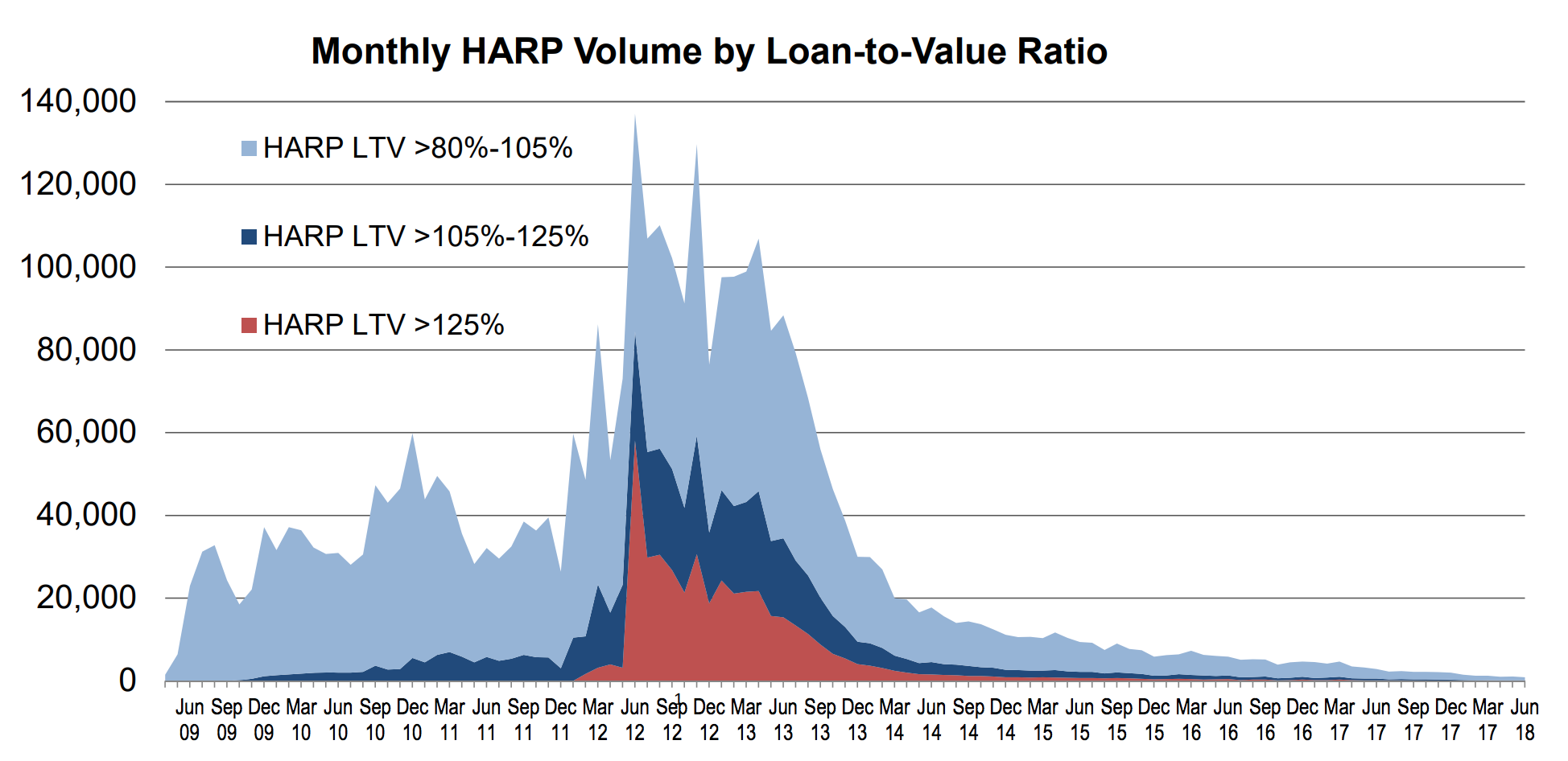

But not only are HARP refinances falling, but the loan-to-value ratios are also growing smaller. The chart below shows that while back in 2012 there was a significant volume with loan-to-value ratios of more than 125%, and even 105% to 125%, now, all HARP volume is made up of refis with LTVs between 80% and 105%.

Click to Enlarge

(Source: FHFA)

In 2018, borrowers with LTVs greater than 105% accounted for 16% of HARP loans through June.

The chart below shows that while many states saw a surge in 2012 and 2013, that has all but tapered off, and even held a 0% market share in some states, such as Idaho and California. Illinois held the highest share of HARP loans at just 3%.

Click to Enlarge

(Source: FHFA)

In fact, just 10 states accounted for more than 70% of the nation’s total eligible HARP loans with a refinance incentive. Those states, listed in order, include Illinois, New Jersey, Ohio, Florida, Michigan, Pennsylvania, Maryland, Alabama, Georgia and New York.

In order to be eligible for HARP, borrowers must meet the following criteria:

- Loan must be owned or guaranteed by Fannie Mae or Freddie Mac

- Loan must have been originated on or before May 31, 2009

- Current loan‐to‐value ratio must be greater than 80%, there is no LTV ceiling

- Borrower must be current on their mortgage payments at the time of the refinance

- Payment history – borrower is allowed one late payment in the past 12 months, as long as it did not occur in the 6 months prior to the refinance

Data from the FHFA shows nearly 50,000 borrowers could still benefit financially from a HARP refinance. These borrowers could save an average of $2,290 annually by refinancing through the program.