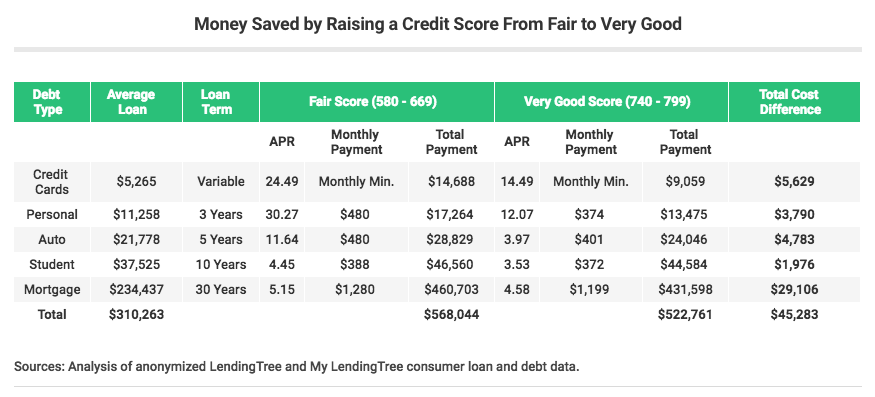

Want to keep a cool $45,000 in your pocket? Fix your credit.

According to a study by LendingTree, raising your credit score from "fair" (580-669) to “very good” (740-799) saves $45,283 on a common array of debts. That’s more than the 2016 median earnings in America ($31,334 before taxes).

On an average mortgage ($234,437), people with very good credit scores will pay $197,161 in interest over the life of the loan, whereas people with a fair score will pay 226,266 over the life of the loan. That’s a difference of $29,106, and the mortgage payment would be $81 less for the homebuyer with great credit than for the homebuyer with fair credit.

The rest of the $45,000 in savings comes from having a great credit score on personal, auto, student and credit card loans.

So how do you get on track?

Pay down your outstanding balance(s), avoid taking on more debt and make your payments on time.

And if you’re having a hard time with self-control, just think: what would you do if you had an extra $45,000?