NRMLA Carefully Reviewing HUD Proposed Rule

NRMLA has convened subject matter experts from every segment of the industry to help analyze HUD’s expansive proposed rule entitled Federal Housing Administration (FHA): Strengthening the Home Equity Conversion Mortgage Program.

“HUD’s leadership has continually voiced its support for the HECM program throughout the Obama administration as the department has sought to put it on a sounder financial footing,” said Peter Bell, NRMLA President & CEO. “These proposed regulations are another step in this process of strengthening the program, an effort that has been underway for a few years now. In developing the regulations, HUD has to consider the perspectives of many stakeholders—homeowners, housing counselors, lenders, consumer advocates and GNMA investors, to name a few. It is not an easy task to balance the needs and concerns of all.”

The proposed rule, published in the Federal Register on May 18, seeks to codify existing regulations published by FHA via Mortgagee Letter following the enactment of the Reverse Mortgage Stabilization Act of 2013, and also proposes changes that would impact the industry.

“Now we must all digest what has been proposed, project the potential impact and provide thoughtful comments back to HUD for its further consideration. We welcome this opportunity,” says Bell. NRMLA will provide future updates as we analyze the proposed rule. The 60-day public comment period ends July 18, 2016. Take a Stand Against Elder Abuse

Each year an estimated 5 million, or 1 in 10, older Americans are victims of elder abuse, neglect or exploitation. According to the Administration for Community Living, for every case of elder abuse or neglect reported, as many as 23.5 cases go unreported.

As professionals who work closely with older adults, we have a special responsibility to be able to recognize the signs of elder abuse, especially of financial exploitation, and provide victims with resources to find the help they need.

As part of World Elder Abuse Awareness Day (WEAAD) on June 15, the National Aging in Place Council and the National Reverse Mortgage Lenders Association hosted a free online tutorial to provide professionals with strategies for keeping older adults safe from financial predators.

A recording of the webinar can be downloaded from NRMLAonline.org.

Launched on June 15, 2006, by the International Network for the Prevention of Elder Abuse and the World Health Organization at the United Nations, WEAAD provides an opportunity for communities around the world to promote a better understanding of abuse and neglect of older persons by raising awareness of the cultural, social, economic and demographic processes affecting elder abuse and neglect.

Legislative Updates

THUD Appropriations On May 24, the Appropriations Committee in the House of Representatives passed the Fiscal Year 2017 Transportation, Housing and Urban Development, and Related Agencies (THUD) appropriations bill that includes $38.7 billion for HUD programs.

The appropriations bill provides $55 million for housing counseling and extends FHA’s authority to continue insuring Home Equity Conversion Mortgages when the new federal fiscal year begins on October 1. The full House must now vote on the legislation.

The Senate passed its own THUD Appropriations bill. If the House of Representatives passes a bill, the two versions will have to be reconciled and signed into law before the new fiscal year begins on October 1. If that doesn’t happen, then Congress must pass a continuing resolution that keeps the government running at current funding levels.

Transitional Licensing On May 23, the House passed bipartisan legislation that would allow loan originators to obtain a temporary license when transitioning to another financial institution or moving to another state. The SAFE Transitional Licensing Act of 2015 (H.R. 2121) is currently pending action in the Senate.

Reverse Mortgages In the News

- “Why a Reverse Mortgage Could Be Right for You” is a video segment featuring best-selling author Jane Bryant Quinn, who explains why her opinion of reverse mortgages has changed during an interview with Donna Rosato, a senior writer for Money New rules for reverse mortgages have removed some of the pitfalls that made them problematic in the past, says Bryant Quinn, and financial planners are learning to use them in creative ways.

- Aging Today, the American Society on Aging’s newspaper, published an article by Alicia Munnell, Director of the Center for Retirement Research at Boston College, who writes, “Accessing home equity will become increasingly important in a world where retirement needs are expanding, and the retirement system is contracting… For older adults who want to remain in their homes, reverse mortgages offer a way to do that by using home equity.”

- “Four Ways to Create Your Own Pension,” a Kiplinger article by Scott Hanson, CFP, a financial advisor and co-founder of Hanson McClain Advisors, , recommends reverse mortgages as one of four ways to create a monthly income stream. Hanson McClain Advisors is a financial planning and investment advisory firm with over 4,000 clients nationwide.

- In a column titled “Reverse Mortgages Don’t Make Sense for Everyone,” nationally syndicated personal finance writer Scott Burns responded to a reader’s concerns about the level of home equity that can be depleted by a reverse mortgage. The reader spoke of an acquaintance in her 90s, who got a reverse mortgage while in her 70s. She can no longer support herself and needs to sell her home. But the loan balance exceeds what the home is worth, so she has no equity to put herself into a nursing home or hire caregivers. While sympathetic, Burns pointed out that the situation could have been avoided if the acquaintance had sold her property sooner, when there was still plenty of equity. “Instead, she lived many years, independently, in a home she wanted to stay in,” he wrote. “The issue here isn’t the tool; it’s that she has lived longer than her home equity could support. Reverse mortgages are a financial tool. They are not a free lunch.”

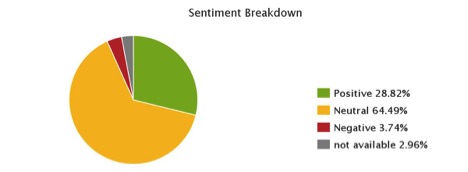

Here’s a look at the sentiment of reverse mortgages in media coverage from the month of May. This analysis is from PR Newswire’s Agility Media Monitoring Platform:

New CRMP NRMLA congratulates James Peter Christopoulos for achieving the status of Certified Reverse Mortgage Professional. Christopoulos has over 35 years of FHA lending experience, including the past three years working for Silex Financial Group, Inc., headquartered in Hawthorne, New Jersey.

New Members NRMLA welcomes its newest members:

- CrossCountry Mortgage, Inc., based in Mandeville, Louisiana

- Alliance Financial Resources, LLC, Phoenix, Arizona