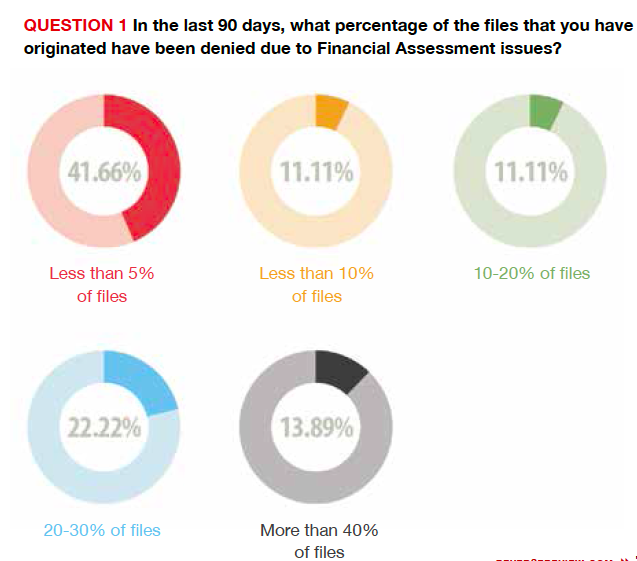

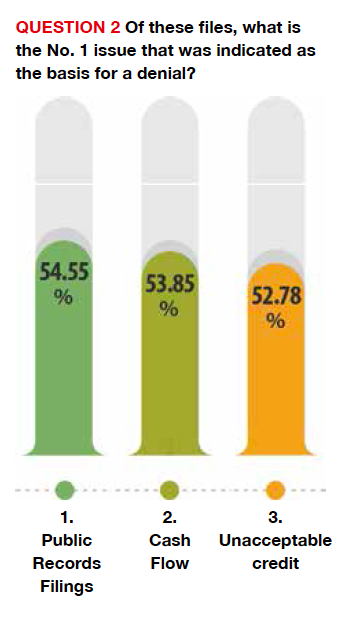

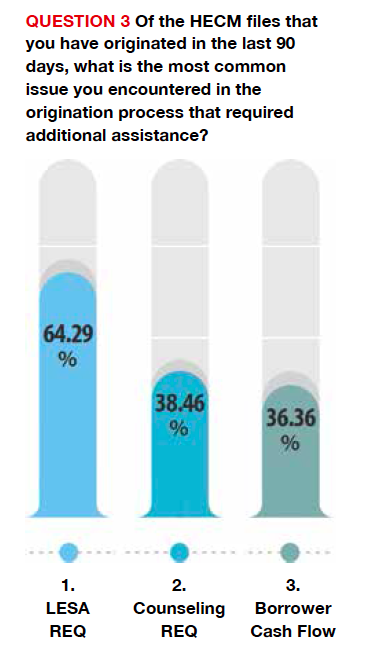

Financial Assessment is officially 1 year old. To mark this anniversary, we’ve asked our readers to participate in a survey to determine the true impact of the new guidelines. The survey was not designed to foster gripes, but inspire thought and discussion as to how we can improve our own practices to better accommodate FA.

In total, 76 HECM professionals around the country responded to our survey last month, answering questions that can help us gauge how the rules have affected prospective borrowers. Has FA helped eliminate seniors who were unlikely to succeed in the program, or has it impeded a responsible segment of borrowers from enjoying the benefits of a HECM? How have lenders fared under FA? Have processes been successfully adjusted to accommodate the guidelines, or is more education and training needed to develop better practices and a smoother workflow?

Tell Us How You Really Feel

At the end of our survey, we asked participants to include their thoughts on how Financial Assessment has impacted the reverse mortgage space. Here are some of their comments:

“Other than the extra time and energy, I haven’t found the FA to be a burden.”

“We ‘pre-underwrite’ all prospective borrowers before fully processing them, and thus do not have loan denials. But this takes much more origination and processing time than before FA.”

“Document collection is long and difficult. Lenders interpret FA differently. Rules are evolving. Willingness is difficult, especially where different states have different definitions of delinquent.”

“It has made my work a lot more complicated and it has materially contributed to the borrower’s skepticism. Many seniors don’t have all of the documentation readily available. Some just throw up their arms and say, ‘Forget it.’”

“The number of times we as loan originators have to go back to the borrowers for more and more and then even more information and documentation is very upsetting and discouraging for the client. They become frustrated with us. There seems to be too many people handling the file and there are delays as a result.”

“All in all it has not greatly impacted my work; there are just more guidelines to follow.”

“Too many people are getting turned down when I think an exception could have been made. I’m closing fewer loans now since Financial Assessment has started.”

“It takes me twice as long to gather the information upfront and explain the guidelines on Financial Assessment and LESA to the borrower… But the process has been better than I originally expected.”

“Overall, I feel FA improves the product for both the borrower and lender!”

“I feel the FA ruling is a good thing for the reverse mortgage industry… If loan originators would embrace the FA ruling in a positive manner, many would find it would work to their advantage!”

“Financial Assessment has made the loan process more complicated for consumers. Thus, consumers are leaning more toward equity loans, which have recently become easy to get. HECMs have become more complicated and restrictive, and equity loans have become more common and simplified.”

“It has not been that bad. It only cost me one or two loans in the last year.”