On the Docket: Golding to Congress: HECM Reforms Working

Edward L. Golding, principal deputy assistant secretary for the Office of Housing at HUD, testified before Congress that extensive reforms to the HECM program over the past two years have had the desired effect of minimizing losses to the Mutual Mortgage Insurance Fund.

“Now, with the benefit of two years of data, FHA can see that these changes appear to be having positive results,” Golding informed lawmakers on the Subcommittee on Housing and Insurance during a public hearing on the health of FHA, held February 11.

In his testimony, Golding said less risky adjustable-rate loans accounted for 84 percent of HECM endorsements in 2015, that more people are withdrawing less money at closing, and that borrowers are not making large withdraws after the first 12 months but are instead preserving their equity for future use.

Despite the good news, Golding cautioned that challenges remain and HUD continues to further examine how to reduce the negative effects of tax and insurance defaults.

High Reverse Mortgage Satisfaction Levels A new survey of seniors who were counseled for a reverse mortgage shows that homeowners who went on to obtain a reverse mortgage rated their overall life satisfaction higher than those who didn’t. A team of researchers from the Ohio State University, led by Dr. Stephanie Moulton, interviewed more than 1,700 seniors and found that on average, reverse mortgage borrowers are significantly more satisfied with particular areas of their lives than non-borrowers, including the condition of their inhabitance, their daily life and leisure activities, family life and their present financial situation.

The study also examines the primary reasons consumers considered a reverse mortgage. Covering everyday, non-health-care expenses tops the list.

In the News In January, Yahoo! Finance published a series of articles about reverse mortgages:

- Seniors Explain: Why We Got a Reverse Mortgage, by Marcie Geffner, profiles a couple and a single borrower, who both explain why they got a reverse mortgage and how it has benefited them.

- Using a Reverse Mortgage to Pay Off First Mortgage, by Polyana da Costa, explains how a reverse mortgage that is used to pay off a conventional mortgage can be a good option for some people.

- Reverse Mortgage and Telling Your Adult Kids, by Marcie Geffner, offers advice on when to involve adult children in the reverse mortgage discussion.

- Reverse Mortgage: Better Than Other Options?, by Don Taylor, Ph.D., weighs the pros and cons of reverse mortgages in response to a question submitted by a couple who wanted to know whether they should consider one as part of their retirement plan.

- Reverse Mortgage: A Step Forward for Some Seniors?, by Donna Fuscaldo, offers general background information on reverse mortgages and advice from NRMLA President Peter Bell.

- Should You Use a Reverse Mortgage to Buy a Home?, by Janna Herron, describes the benefits of using a reverse mortgage to purchase a new home and how the process works.

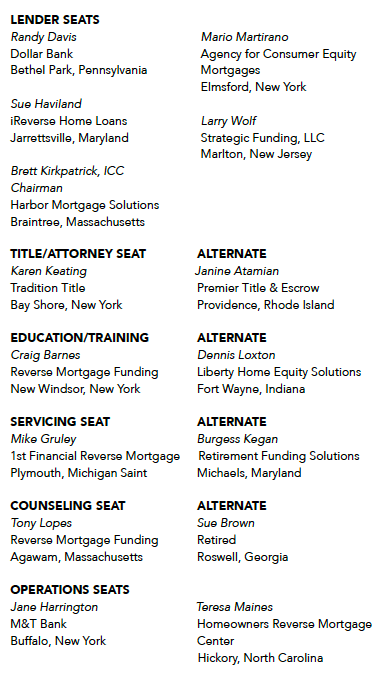

At NRMLA: Subject Matter Experts Appointed to ICC Sixteen reverse mortgage industry veterans were unanimously appointed to serve on the Independent Certification Committee for the 2016 term. A Nominating Committee Report prepared by a small subgroup of existing ICC members was circulated for ratification to all 114 Certified Reverse Mortgage Professionals.

The ICC, which oversees the CRMP designation, comprises subject matter experts from a diverse set of backgrounds, such as loan origination, title/legal, operations and counseling. We had more applicants than we had seats for, and the strength of all the applicants was impressive and gratifying. We thank everyone who submitted an application.

Helping Our Clients Age in Place As we age, the ability to remain active and independent requires a steady stream of services. Three-quarters of Americans will need in-home care at some point in their lives. That’s according to Sherwin Sheik, owner of Sacramento, California-based Carelinx, the largest caregiver marketplace in the United States, who served as a panelist during the 2015 Annual Meeting and Expo in November. “In-home care is one of the biggest expenses in retirement. Many of these people are potential reverse mortgage clients, because Medicare only pays for 100 days of in-home care, which means people are paying out of pocket if they don’t have other forms of coverage,” he said.

Sheik was among several = experts who discussed the benefits of using reverse mortgages to finance aging in place at the Annual Meeting & Expo. Caregiving is becoming a more widely discussed topic and much of the conversation focuses on the need for methods to pay for it.

Eastern Regional Meeting on Sale Early registration is now open for the 2016 Eastern Regional Meeting and Finance & Investment Forum, April 4-5, at the InterContinental New York Times Square.

Join us as Wall Street, Washington and the reverse mortgage community come together to discuss current market trends and issues.

Be on the lookout for the opening of registration for our 2016 Western Regional Meeting, May 10-11 at the Hyatt Regency Hotel in Huntington Beach, California.

New Members BBMC Mortgage, LLC Lombard, Illinois Valley West Corporation dba Valley West Mortgage Las Vegas, Nevada Resolute Bank Maumee, Ohio Silex Financial Group, Inc. Hawthorne, New Jersey Lakeland Bank Oak Ridge, New Jersey

New CRMPs Leonard (Pudge) Erskin Banc of California NA dba Reverse Mortgage Works Beverly Hills, California Cory Williams Springwater Capital Salt Lake City, Utah

George Vrban PS Financial Services Saint Augustine, Florida

Jim Schwegman Liberty Home Equity Solutions Irvine, California

Traffic to reversemortgage.org (January 16-February 15)

32,718 unique users (compared with 26,418 for December 15-January 15) 80,751 page views (compared with 64,732 for December 15-January 15)