Our industry continues to evolve and reshape itself every day. Loan officers, counselors, processors, servicers and other professionals across the reverse space have come to realize that proactively learning is the only way to keep one step ahead of the relentless, continuous change in this market. As our borrowers and their advisors become more knowledgeable of the reverse product, we too need to stretch our own view of things commensurately. Over the years, most of us have come to master our respective jobs. Whether we’re taking appointments, counseling borrowers, underwriting loans or closing sales, we’re doing—so far—better today than yesterday. While always improving, we’ve got our reverse expertise down pat. The resharpening of critical competencies has become routine.

So now is a good opportunity to begin broadening our view and expanding our knowledge of another key part of our growing industry, specifically the secondary market.

This article is a high-level view of this critical component of the reverse market, a description of several of its moving parts and a look at how they are linked together.

By developing a basic understanding of the bigger picture, we become more competent and far more confident doing our work and engaging our borrowers. The ability to discuss such things as the secondary market, securitization or HMBS (just at a conceptual level, if ever needed) enhances professional credibility.

Certainly, the vast majority of our borrowers could care less about such things, but their advisors or family members may care. In either case, being prepared with even a snippet of knowledge could not only help our borrower, it could also help us as reverse mortgage professionals develop a broader understanding of our business in its entirety.

For example, the following questions from borrowers and their advisors can naturally be expected in greater frequency regarding reverse financials alone. Such questions will no longer be relegated to just “what is,” but rather “why is,” “how does” or “how come.”

For example, the following questions from borrowers and their advisors can naturally be expected in greater frequency regarding reverse financials alone. Such questions will no longer be relegated to just “what is,” but rather “why is,” “how does” or “how come.”

“Why did the reverse interest rate change since we last spoke?”

“This is the second time I have checked out a reverse mortgage for my client recently. Why have the costs gone up?”

“Why is the lender giving my mother this rate and that other lender giving her a different rate?”

“I understand the government, not you, sets reverse interest rates. What gives?”

“Why do prices vary with different types of reverse mortgages?”

“My father believes lenders are just trying to make more profit off of us by changing rates. Is this true?” “Why can’t I lock in the rate? I remember doing so on my first home mortgage.”

“What’s the real price of a reverse, anyway?”

Of course, the answers to these and similar questions are deeply embedded within (and actively driven by) the secondary market. There is always a plurality of factors at play that influence the numbers involved in a reverse mortgage. It’s not just about lenders.

Reverse Mortgage magazine, NRMLA’s flagship publication, recently published an outstanding article on the creation, history and dynamics of HMBS and the secondary market. Author Marty Bell simply defined the importance of this sector, stating, “HMBS provides the money for lending that broadens the availability of loans to seniors.” The article goes on to discuss the silent interdependencies that exist between the reverse investor community (i.e., the secondary market) and the primary market (i.e., the community focused on lending reverse mortgages to consumers, where most of us work each day). Even though the vast majority of seniors could likely care less about such matters, anyone directly engaging them (or their advisors) should be prepared to at least discuss a few fundamentals when warranted.

In order to do so, we must first step back and begin broadening our own perspectives. It is often thought that reverse lenders are responsible for all financial factors associated with a reverse mortgage. While lenders directly impact reverse interest rates, costs and prices, they never do so in isolation. There are many factors that directly influence reverse business and financial decisions, including timing, risks, products, market expectations, leaders, technologies, government, etc.

As a matter of fact, there is a plurality factors silently, relentlessly impacting reverse mortgages every day. Lenders are only one. HERE ARE FIVE: A. Plurality of Views B. Plurality of Players and Definitions C. Plurality of Products D. Plurality of Influences E. Plurality of Processes

A. PLURALITY OF VIEWS Most of us focus on the immediate next steps needed to help our seniors through the reverse mortgage process, from initial engagement, qualification and application, to closing, funding and servicing. As such, our priorities are concentrated on explaining reverse fundamentals, product features/benefits and loan requirements, or on fixing borrower problems. These are very important activities requiring highly focused attention.

There’s also a difference in viewpoints and priorities between borrowers and lenders. Key financial factors are usually most important to borrowers and center on reverse interest rates, costs or principal limits (i.e., how much money they can get). These are very important factors to lenders, too. But lenders also need to consider those “silent” factors directly affecting borrowers that are seldom discussed, including FHA parameters, CFPB requirements, Ginnie Mae guidelines and the volume of issuers and investors. The integration of these different views and priorities may seem unimportant, but each plays a role in the business of reverse mortgages.

B. PLURALITY OF DEFINITIONS AND PLAYERS Reverse loan officers, counselors and servicers often hear seniors (or their advisors) routinely misinterpreting the meaning of certain terms and concepts (e.g., price vs. cost, expected rate vs. initial rate, lender vs. servicer). This is only natural given the many complexities of the reverse market. Clarifying the technical differences is not needed every time, but when necessary, effectively addressing key concepts can make the difference between enhancing understanding or contributing to needless misunderstanding. The following are a few reverse-oriented definitions and industry players that may help foster a better understanding of the bigger picture:

INSURER Government entity that guarantees investors the timely payment of principal and interest on HECM mortgage-backed securities (e.g., HUD)

ISSUER A mortgage company that has been approved by Ginnie Mae (the “guarantor”) to sell pools of HECM mortgage-backed bonds/securities to investors (e.g., Reverse Mortgage Solutions, Urban/Knight Financial Group, Sun West Mortgage Company, MetLife Bank)

INVESTOR An enterprise or individual who purchases reverse mortgage bonds from approved issuers (e.g., commercial banks, foreign central banks, domestic mutual funds insurance companies, pension funds, investment banks)HUD/FHA Federal organizations that insure HECMs and established HECM program standards

GINNIE MAE (GNMA) Government agency that securitizes federally insured or guaranteed loans such as HMBS (Note that Ginnie Mae sets HECM investor guidelines and approves issuers of HMBS.)

CONSUMER FINANCIAL PROTECTION BUREAU (CFPB) Government agency that enforces standards for consumer protection, including seniors purchasing reverse mortgages

NATIONAL REVERSE MORTGAGE LENDERS ASSOCIATION (NRMLA) The professional society of the reverse mortgage industry responsible for helping educate the public about reverse mortgages; sets and enforces the professional ethical standards for acceptable business conduct in the industry

PRIMARY MARKET Deals with the issuance of new investment instruments (e.g., securities, stocks, bonds) that benefit a specific company or institution (Note that any reverse lender can sell his own stock or bonds to anyone.)

SECONDARY MARKET Deals with the selling of pools of investment instruments bundled together to investors around the world (Note that only approved entities are qualified to make such instruments available to investors; these entities are called “issuers.” Ginnie Mae must also approve institutions that can offer reverse mortgage investment instruments to investors around the globe.)

HECM MORTGAGE-BACKED SECURITIES (HMBS) Ginnie Mae-issued securities (i.e., an investment instrument) designed to attract investors and promote needed liquidity, which help grow the reverse mortgage secondary market and lead to overall growth in the reverse space, making reverse mortgages more available to seniors

SECURITIZATION The process an issuer uses to create a financial instrument (e.g., HMBS or bonds) by combining pools of assets and selling them to investors in the secondary market, which helps strengthen the liquidity of the reverse mortgage industry

VALUE APPRAISAL Assessment of the worth of a HECM consumer’s property on the market conducted by a professional appraiser

PROPERTY CHARGERS Applicable tax and insurance requirements vital to maintain a HECM consumer’s primary residence

RATE The percentage of interest charged to a senior on the money borrowed on a HECM

COSTS Total amount of charges/fees a senior ultimately pays on a HECM [This includes margin, origination fee, mortgage insurance premium (MIP), servicing fee, counseling fee, credit report and appraisal fee—all of which are usually financed.

PRICE The amount of money investors pay for reverse mortgage loans or bonds on the secondary market (i.e., fixed-rate HECM mortgage-backed bond)

REVERSE CONSUMER A purchaser of a reverse mortgage (i.e., a qualified senior)

REVERSE LENDER HUD-approved provider of reverse mortgages to the senior market (e.g., Reverse Mortgage USA)

REVERSE COUNSELOR HUD-approved educator of seniors regarding HECMs

REVERSE SERVICER Company that provides loan servicing on the reverse mortgages sold to consumers

These are just a few of the many definitions, players and organizations that directly influence the overall financial health of our industry, as well as many day-to-day reverse mortgage business decisions.

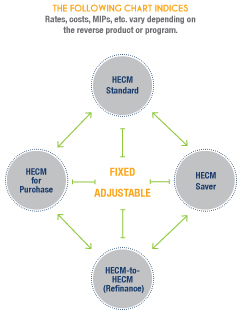

C. PLURALITY OF PRODUCTS In the minds of most seniors and their advisors, only one reverse mortgage exists. However, there are several types of reverse mortgages in our industry. The most common among them is the Home Equity Conversion Mortgage (HECM), which is a government-insured mortgage that has several variations. There is also a “proprietary” reverse mortgage, which is a nongovernment-insured reverse mortgage offered by private banks and mortgage companies.

DIFFERENT TYPES OF HECMS INCLUDE: -HECM Standard (traditional HECM) -HECM Saver (modified HECM with lower up-front costs) -HECM for Purchase (exclusively used for purchasing a different primary residence) -HECM Refinance (for borrowers who already possess a HECM and wish to refinance to another HECM)

The numerous HECM variations offer more choices for

consumers, but they also create potential opportunities for confusion if they are not well presented and understood. There are several commonalities among all HECMs and there are also differences in the requirements for and benefits of each. Additionally, different indices, interest rates, settlement costs, fixed or adjustable programs and MIP schedules vary among HECMs.

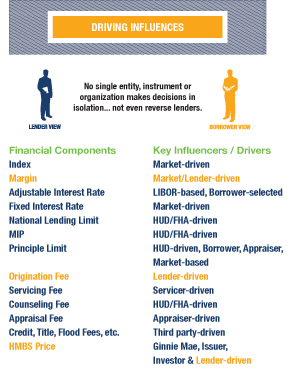

D. PLURALITY OF INFLUENCES At first glance, it’s easy to assume that reverse lenders are the driving force behind all financial elements regarding reverse mortgages. However, many entities across the spectrum impact reverse financials in both obvious and subtle ways. For example, just by viewing the standard financial components of a single HECM transaction, a telling story is revealed (see graphic).

While lenders are involved in all phases of the reverse mortgage process, they are often closely focused on the margin, the origination fee and HMBS pricing. Many other industry players exert equally powerful influence in shaping and reshaping other financial factors, including servicers, appraisers, third-party organizations, HUD/FHA, Ginnie Mae, the global market, issuers, investors and even reverse borrowers themselves.

Each industry player influences things in small and large ways every day that borrowers seldom see (nor really need to fully understand). However, from a borrower’s point of view, reverse lenders are usually the “face of reverse,” because that’s who borrowers interact with throughout the majority of the origination process. As such, they are also often praised or blamed for everything, including financial factors, even though they are not solely responsible.

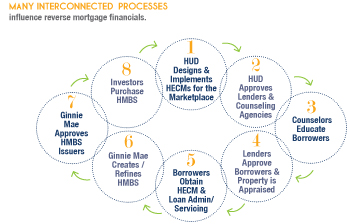

E. PLURALITY OF PROCESSES Many interconnected, interdependent processes also influence reverse mortgage financials. All of us are intimately close to one or more of these high-level processes during our daily activities in the reverse market (see graphic).

From the time HUD develops, implements or changes a HECM (#1), to when a borrower obtains a HECM and enters servicing (#5), to the time an investor actually purchases an HMBS (#8), reverse financials are affected. Even though few of us are personally involved in every process, we should value just how closely coupled these processes are, as well as how interdependent they have become.

When a problem occurs in any single step, the entire reverse mortgage system can be either adversely impacted or significantly improved.

There are so many touch-points made so often by so many people in so many ways that it seems somehow magical watching it come together over and over again. But no magic is involved; it’s all hard work by lots of good people.

Now, take a second and place yourself in the process step(s) closest to your own work, using the graphic. Then look around. We are more interdependent on the effectiveness of each other’s work than we see on a daily basis. Simply broadening our perspectives and looking around now and then is a humbling and exciting thing.

No one entity can do it all in reverse—not even the biggest lenders, the smartest leaders or the best technologies. It takes an industry, and that includes a healthy secondary market.

In conclusion, a plurality of factors influences every dimension of a reverse mortgage, from how a senior chooses a lender to why an investor purchases a specific HMBS. Three key takeaway messages may be helpful:

1. We should try to stretch ourselves to better understand the bigger picture of the reverse mortgage industry.

2. The secondary market is a vital, driving force that is absolutely instrumental in ensuring sustainable liquidity and long-term viability of our entire industry.

2. The secondary market is a vital, driving force that is absolutely instrumental in ensuring sustainable liquidity and long-term viability of our entire industry.

3. Our understanding, empathy and ability to convey the basic concept of plurality can strengthen our own professional confidence.

As much as reverse mortgages continue to be explored by seniors and their adult children, transparency and an understanding of all the factors that impact the industry should be paramount for all—especially the professionals who serve them.