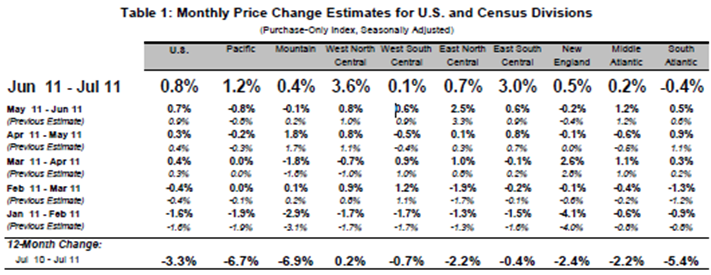

The Federal Housing Finance Authority's Home Price Index (HPI) reported a seasonally adjusted 0.8% increase in national home prices for July. It is the fourth consecutive month that the index has shown increases.

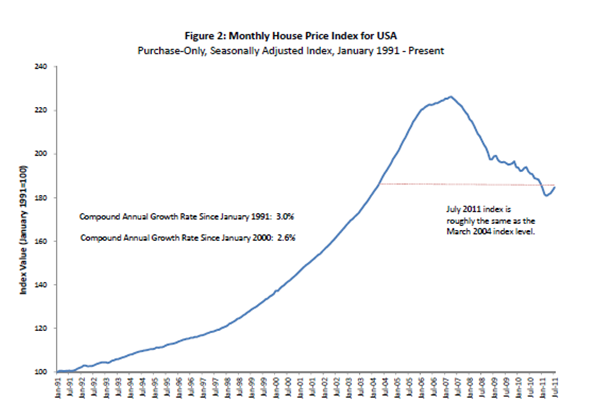

The trend of month-over-month increases has yet to bring increases to the year-over-year data, as home prices have declined 3.3% from the previous July. The index is currently 18.4% below the peak reached in April 2007 and in-line with the level recorded in March 2004.

In the HPI, the FHFA tracks home purchase prices of transactions that had mortgages sold to or guaranteed by Fannie Mae or Freddie Mac. The agency has regulatory authority over the government sponsored entities and is currently the conservator for them.

Regionally, the West North Central, up 3.6% and the East South Central, at 3.0%, led the way with the highest growth for the month. All but one of the nine census regions tracked in the HPI showed increases in July. The South Atlantic broke a string of 3 consecutive positive months to fall by 0.4%.