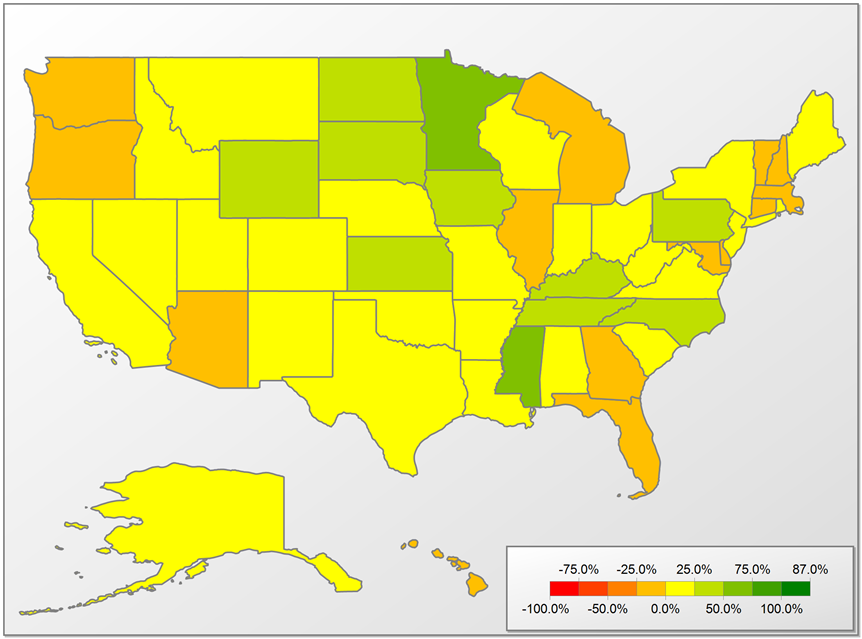

As total HECM endorsement volume trends towards a decrease from 2010, seven out of the top ten states for total units are experiencing positive year-over-year growth in 2011.

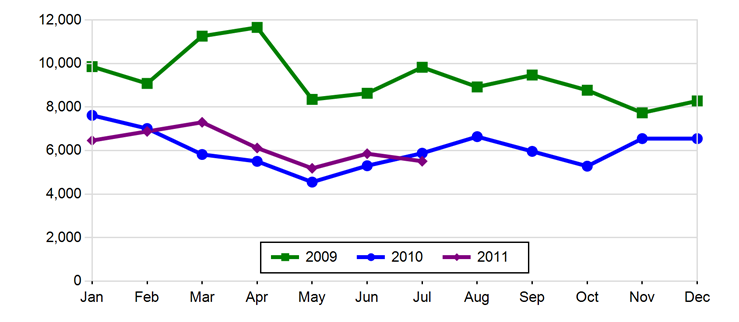

According to the new HECM Trends report from Reverse Market Insight (RMI), endorsement volume for HECM loans trended into positive year-over-year territory in February of this year, now has crossed back over into negative ground. At 43,314 endorsed units through July, 2011 still remains 3.9% ahead of 2010, but the current trend suggests that the industry may be headed toward a third consecutive year of volume declines in 2011.

Among the top ten producing states, California crossed over into positive territory with 3.7% growth (5,955 units) thus far in 2011. Texas solidified its hold on the number two position with 13% growth and 3,770 units. New York, with 10.6% growth (2,602 units) continues to challenge Florida whose decline is at -21.4%, or 2,919 units.

Number 9, North Carolina and number 5, Pennsylvania continue to outpace the rest of the top ten with 38.3% and 27.0% growth respectively. North Carolina continues to be an intriguing member of the top ten especially considering some of the restrictive laws within the state. Lenders in North Carolina must have specific authority from the Commissioner of Banks and brokering reverse mortgages is not permitted. Additionally, borrowers are required to receive counseling face-to-face. Phone counseling is only available on an exception basis for borrowers physically unable to go to a counselor.

The only other two states in the top ten with negative growth in 2011 are Maryland (8th) at -21.9% and Illinois (10th) at -20.8%.

The Endorsement Growth Heat Map shows some bright spots overall in the Northern middle portion of the country, as well as the east. The Western states and upper Eastern North and South extremities continue to lag behind.