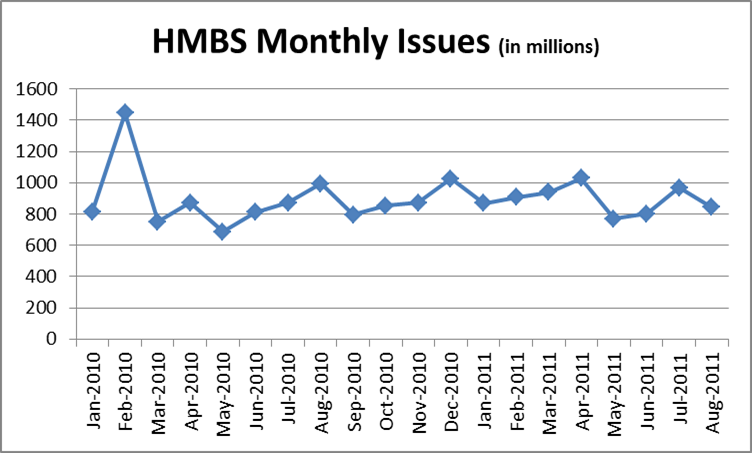

New issues of Ginnie Mae HECM Mortgage Backed Securities (HMBS) fell in August following two straight months of increases.

The $844 million in new issues was a 12.9% drop from the $969 million issued in July. The decline shortened a reoccurring pattern over the past year and a half where HMBS issues would increase for three consecutive months prior to declining.

The average amount of new HMBS issued has also been declining. After averaging $899 million per month in 2010, the average has fallen slightly to $891 million in 2011 and $846 million in the last four months.

HMBS accounted for just over 3% of the $27.8 millon total of mortgage-backed securities issued by Ginnie Mae, and 4.5% of the $18.6 billion total of Ginnie Mae II securities.