In the second version of Reverse Market Insight's (RMI's) revamped reports, the "HECM Originators" examines retail and TPO/broker/wholesale business data through July 2011.

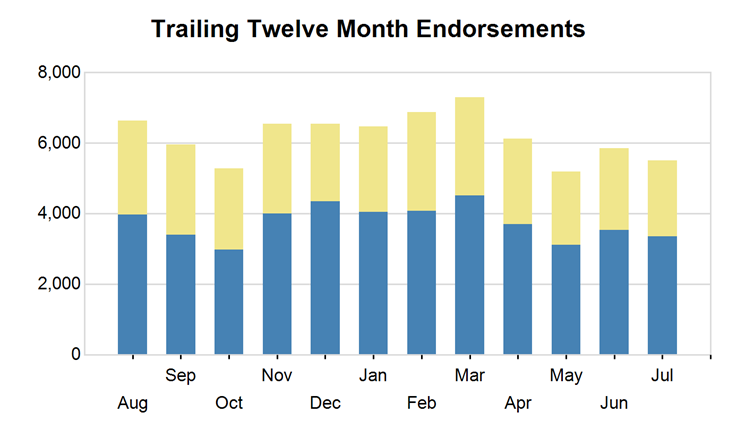

As HECM volume fell 5.9% in July, the retail production saw a small decline (5.2%) compared to the wholesale channels (7.0%).

At 3,352 endorsements, retail volume made up 61% of the total volume, compared to 2,159 units or 39% for wholesale.

The reworked report from RMI seeks to solves changes to the FHA HECM MIC monthly endorsement report that no longer includes the activities of broker's that are no longer issued approvals by the FHA. Accordingly, RMI has added a new element to the HECM Originators Report that the lists the top 100 originators.

The monthly activity for July shows that Wells Fargo's exit has not net taken effect with 1,715 loans endorsed in July. This is not surprising given the trailing nature of endorsements to actual closing dates. A surprise entry in to the top 10 for July activity is All Financial Services with 67 endorsed units. The company ranks 28th year-to-date.