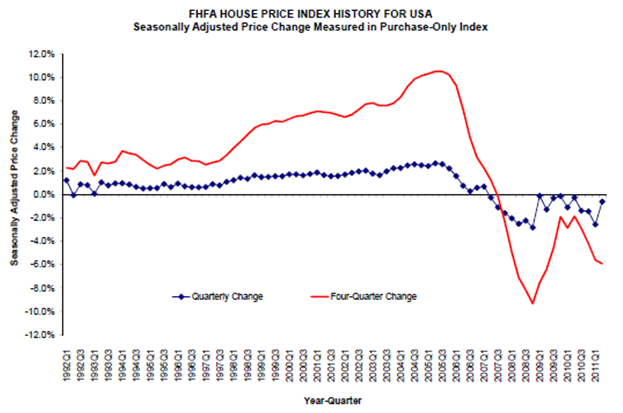

National home prices declined in the second quarter according to the Federal Housing Finance Agency's (FHFA's) purchase only house price index (HPI).

Using home sale price data from Fannie Mae and Freddie Mac, the HPI calculated a decline of 0.6% in the second quarter with an annual decline of 5.9%. Although the monthly HPI saw an increase of 0.9% in June, the level was 18.8% below the peak from April 2007. With prices of other goods rising by 4.5% in the previous year, the inflation-adjusted price of homes results in a decline in value by approximately 10%.

In the all-transactions home price index, which incorporates data from both purchase and refinance transactions, the HPI decreased by 1.9% in the latest quarter and 4.5% from the previous year.

Overall, seasonally adjusted home prices fell in 31 states from the first to second quarters of 2011. In the nine census divisions tracked by the HPI, New England and West South Central divisions experienced the highest gains at 0.7% for the quarter. The Mountain division experienced the steepest decline at 2.3%. Pittsburgh led the list of MSA's for increases with a gain of 3.7% over the previous year. The Atlanta-Sandy Springs-Marietta, Georgia area was the hardest his with price declines of 14.1% for the year.