The number of mortgage fraud cases continued at levels in 2010 consistent with levels identified in 2009. As fraud schemes continue, they have been able to adapt to economic changes and alterations to lending practices.

According to data in the FBI's 2010 Mortgage Fraud Report – Year in Review, the on-going depressed housing market remains an attractive environment for mortgage perpetrators. Fraud schemes have involved virtually all aspects of the lending professions, including Mortgage fraud perpetrators include licensed/registered and non-licensed/registered mortgage brokers, lenders, appraisers, underwriters, accountants, real estate agents, settlement attorneys, land developers, investors, builders, bank account representatives, and trust account representatives.

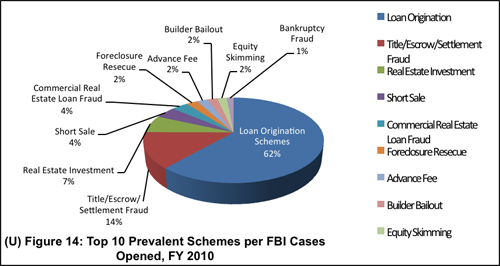

Loan origination schemes were the majority of fraud cases, making up 62% of documented cases. These cases involved two types of fraud. First, fraud for property which involved misrepresentations or falsified information on mortgage applications for the purpose of acquiring a property. These cases usually involved single loans for the purpose of purchasing a home as a primary residence with the intent to repay the loan. The second type is fraud for profit, which typically involves multiple loans that use misrepresentation with appraisal values and loan documents with the goal to gain illicit proceeds from property sales.

The second most common fraud involved title/escrow/settlement services. These types of fraud resulted from some sort of diversion or embezzlement of funds for uses other then dictated by the lenders instructions.

Although fraud involving reverse mortgages did not make the list of the top ten fraud schemes, the report noted that it does remain a concern. Cases of reverse mortgage fraud reported by Fannie Mae included the use of asset misrepresentation, occupancy fraud, and identity theft.

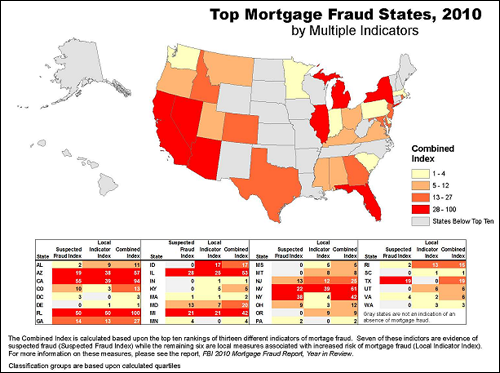

Combing data from multiple sources, the report evaluated states based upon the number fraud cases reported and levels of vulnerability. According to this analysis, the top mortgage fraud states were Florida, California, Arizona, Nevada, Illinois, Michigan, New York, Georgia, New Jersey, and Maryland.

The FBI's report stated that the continuing level of mortgage fraud cases requires the agency to continue to dedicate significant resources to the threat. In an operation in 2010 involving the FBI and the Department of Justice, 1,215 criminal defendants were involved related to more than $2.3 billion in losses.