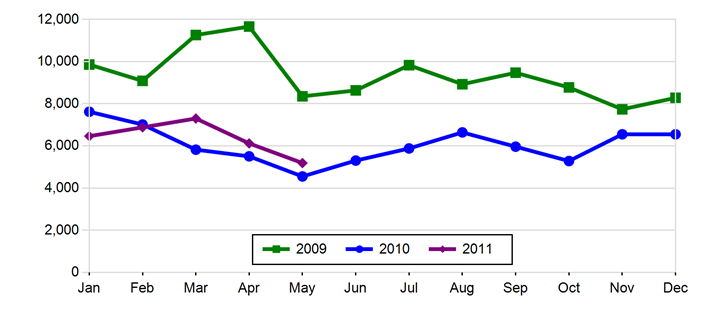

After starting the year on an encouraging upswing, the year-over-year HECM endorsement volume has fallen into a similar trend line to the previous year.

Although still head of the pace of 2010, the gap narrowed in the latest Industry Trends Report from Reverse Market Insight. The endorsement volume reached a 12 month peak in March before falling back below 6,000 units. Optimistically, if the trend line continued to mirror 2010, the industry would see consistent rise heading into the fall.

Unfortunately, with the exits of Bank of America and Wells Fargo showing their full impact during this window, it is more likely that industry volume will continue to fall before the market is able to effectively absorb the potential units left by those lenders.

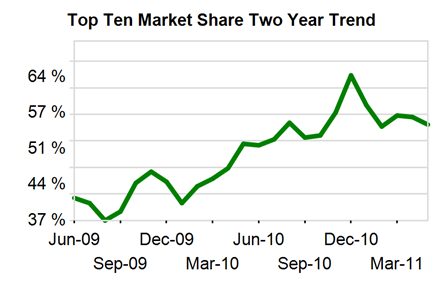

This has also led to the leveling off of the market share controlled by the top 10. Following a peak of over 64% at the end of 2010, the level has fallen below 57%.

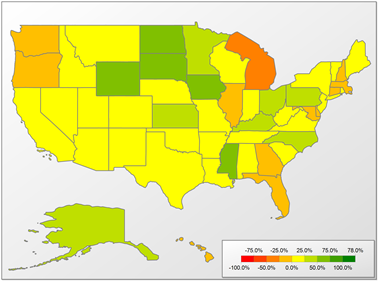

Geographically, California continued its stranglehold on the top spot with Los Angeles, Orange and San Diego counties holding the first, second and third spots for leading counties. Texas widened its gap over Florida for the number two spot showing 13.5% growth for the year to date. Percentage wide, Pennsylvania and North Carolina continued to display the largest continued surges with growth of 34.5% and 44.8% respectively. This is especially interesting for North Carolina considering that state law requires prospective borrowers to receive counseling face-to-face.

The endorsement growth heat map is finally stating to show some color. After months of yellow and orange, signifying stagnent or negative growth in many states, some green, pointing to growth, is beginning to appear.

Although the industry total endorsement volume will continue to decline, due to the reality that it will take some time to replace the volume gaps created by large lenders, there will be interesting trends to watch, not only in the make up of the top 10 and distribution of market share, but also in state distribution. With fewer national lenders and MetLife's transition to a state licensing format, the industry could find more state concentration as regional lenders seek to capitalize on the new opportunity.