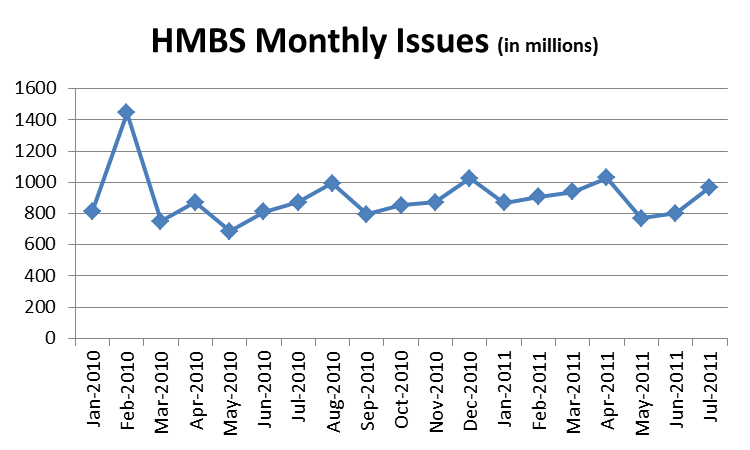

Monthly issues of Ginnie Mae HECM Backed Mortgage Securities (HMBS) continued a see saw pattern with total volume increasing to $969 million in July.

Since April 2010, monthly issues of HMBS have fallen into a four month pattern where total volume increases for three consecutive months before falling backing. The jump in July of $168 million over June’s volume of $801 million marked the second consecutive increase since volume from dropped from $1.029 billion in April to $771 million in May.

During this period the amount of HMBS issues have fallen between a range of $686 million in May 2010 and the high of $1.029 billion in April of this year. The average monthly issue volume in this window has been $879 million.

The increase in July of 21% was the largest month-over-month increase during the period represented in this pattern. The jump follows the largest monthly decrease of 25% in May and a slight increase of 3.89% in June.

Should the current pattern continue, monthly HMBS volume will increase one more month before falling in September. However, another dynamic in the pattern is that the largest jumps in volume have also been followed by the largest declines.