June marked a positive jump for HECM endorsement volume as the top lenders, minus Wells Fargo and Bank of America, continue to capture market share in the Retail Leaders Report for June from Reverse Market Insight.

Seven of the eight remaining lenders have grown in the last three months, while the industry declined 4.4% during this time period. The top ten amounted to 74% of retail volume for the month. MetLife has seen the brunt of the growth from 616 units in April, to 932 in May and up to 1,079 in June; as Bank of America wound down their pipeline from 896, to 332 to 7 in June. One Reverse Mortgage is only member of the remaining top eight to trend downward in June.

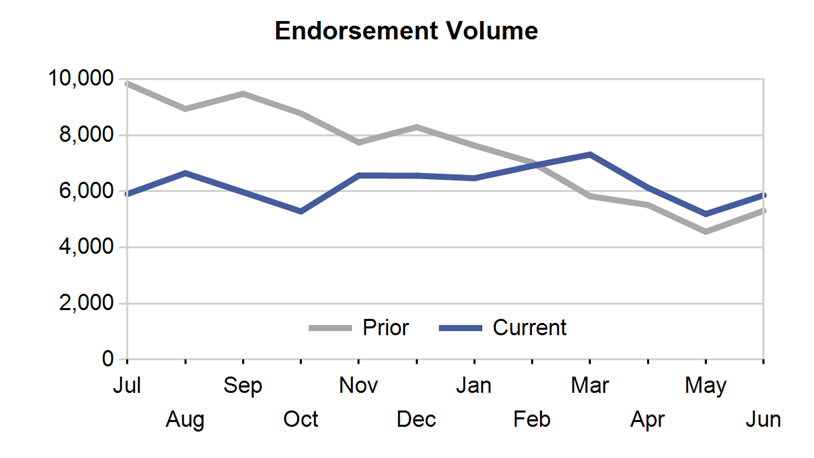

Since crossing over to positive year-over-year growth in February, endorsement volume has followed a similar trend line to the previous year. If this trend continues, the industry would spike in August before drifting off into September and October. However, the absorption rate of the volume void left by the exits of the big banks may have a significant impact on this trend line.

RMI notes that the expected HECM program changes have had more of an impact on the industry than the exits, thus far. Accordingly, pending announcements from HUD regarding changes to the financial assessment of borrowers and additional policy regarding tax and insurance defaults, could have greater influence over HECM actively.

From a regional perspective, the improvement in June endorsement volume was felt across all regions, fueled by large increases in the Mid-Atlantic and Southwest regions over the previous month. Year-to-date, New York/New Jersey is leading growth with a rate 15.9% ahead of last year, followed by the Great Plains at14.5% and the Southwest at 13.2%. The Northwest/Alaska (-4.1%) Mid-Atlantic (-.03%) and New England (-0.3%) are the only regions in negative territory for the year.