Although U.S. home prices continued a downward trend, the latest Home Data Index Market Report from Clear Capital suggests signs that home prices are stabilizing, fueled by the upcoming summer buying season.

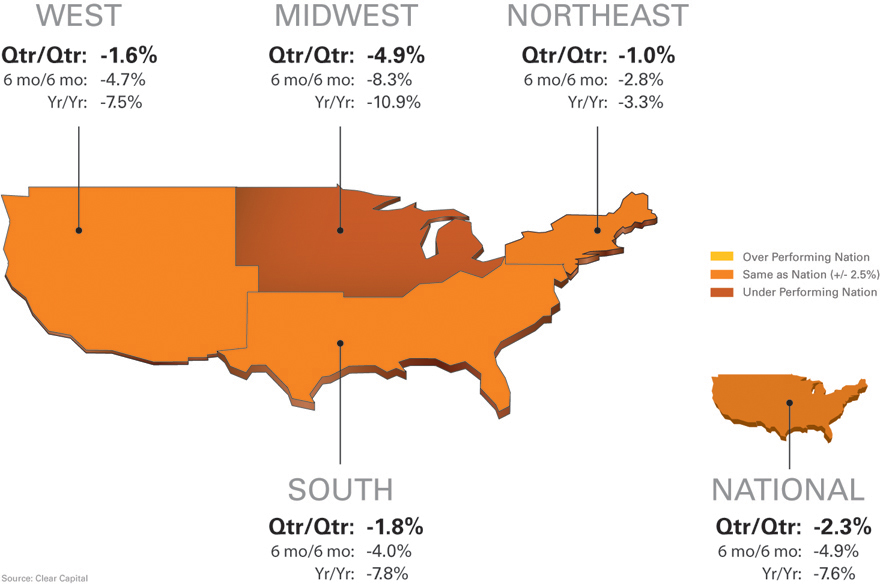

With data through May 2011, the report indicated a quarter-over-quarter decline in home prices of 2.3%, which was 50% less than last month's report. The REO saturation also declined by 0.6% to 33.9%.

“The latest Market Report results through May suggest that home prices are starting to ease back from the heavy declines seen over the winter,” said Dr. Alex Villacorta, director of research and analytics at Clear Capital. “We are still far away from the strong demand needed to fully turn things around for the housing market; however, it is clear from the initial spring sales data that prices are softening, suggesting stabilization in the market."

After reporting a nationwide double dip last month, this month's index points to signs that the summer buying season will see an increase in the share of non-REO transactions. According to past trends in the HDI Market Report, as the saturation of REO sales declines, national home prices tend to rise. Additionally, the median price for distressed properties saw an increase of 5.0% in the fourth quarter of 2010 as the volume of sales declined.

Regionally, seven of the top 15 markets posted quarter-over-quarter gains compare to the previous month's report., led by Washington DC – Arlington, VA – Alexandria, VA at 4.5% and St. Louis, MO at 2.2%. However, 12 of the 15 best producing major markets still point to year-over-year declines, suggesting that the latest trend is still pushing to gain momentum.