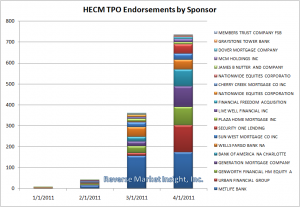

Third party origination (TPO) of HECM loans continued it's upswing by more than doubling in April from 360 to 735 loans in the Wholesale Leaders April 2011 report from Reverse Market Insight.

TPO's made up 30% of all wholesale loans in April. MetLife, which jumped out ahead of the other wholesale lenders in March, remained static while other lenders began to pick up pace.

Following the official end of correspondent approvals by FHA and the conversion to lender sponsorships in January, it appears that lenders are getting a handle on managing the TPO relationships. A question to consider as this dynamic takes shape with be if the lender sponsorship creates a greater connection between lenders and their TPO's that leads to less shifts by TPO's to other lenders. Essentially, will the nature of the sponsorship relationship create any type of hindrance of the pricing and service competition that was inherent to the traditional wholesale channel?

As noted in the Retail Leaders Report, endorsement volume dropped by 16.2% in April. This was fueled by an 18% decline in retail volume and a 13.3% decline in wholesale volume. The decline slightly narrowed the gap between the channels by 2% with retail at 3,704 units and wholesale at 2,415.

MetLife and Wells Fargo experience the largest drops in the month. Together they account for 44% of the industry volume, but accounted for 88% of the decline in April. With the May Retail Leaders numbers, it does appear that this represented much more of a blip for MetLife, but has the potential to be the start of a trend for Wells Fargo.

The Top 10 lenders, through both retail and wholesale channels, continue to control the market with their hands touching over 91% of all endorsements.