Sales of bank-owned homes and those in some point of the foreclosure process accounted for 28 percent of all residential sales according to the Q1 2011 U.S. Foreclosure Sales Report from RealtyTrac.

The percentage is just a slight increase over the 27 percent of sales that these homes amounted to in the fourth quarter of 2010 and just slightly below the 29 percent from the first quarter of 2010.

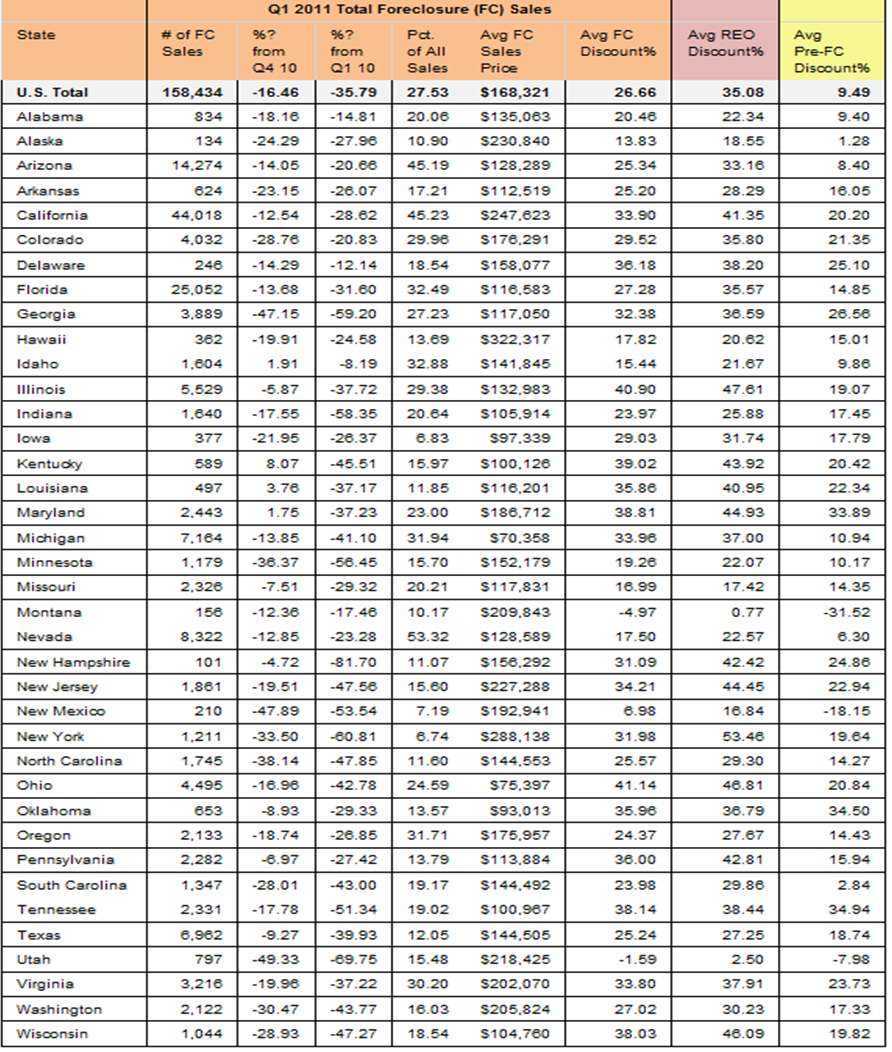

The average sales price of homes in a stage of foreclosure, in default, scheduled for auction or bank-owned was $168,321, which was a 1.89 percent decrease from the previous quarter and 1.46 below the same quarter in the previous year. Compared to homes not in a distressed state, these homes sold on average for 27 percent less.

“While foreclosure sales continue to account for an unusually high percentage of all residential home sales, sales volume is well off the peak we saw in the first quarter of 2009, when nearly 350,000 foreclosure properties sold to third parties,” said James J. Saccacio, chief executive officer of RealtyTrac. “While this is probably helping to keep home prices relatively stable, it is also delaying the housing recovery. At the first quarter foreclosure sales pace, it would take exactly three years to clear the current inventory of 1.9 million properties already on the banks’ books, or in foreclosure.”

Of the 158,434 distressed properties that were sold in the quarter, 107,143 were bank owned, 19 percent of all sales. This is a drop of 11 percent from the previous quarter, and 30 percent below the previous year. The remaining 51,291 were homes in a foreclosure stage, making up 9 percent of all sales.

Looking at individual states, the three states with the highest percentage of distressed sales were Nevada at 53 percent, California and Arizona, both at 45 percent. The states with the highest percentage of discounts were Ohio and Illinois at 41 percent, and Kentucky at 39 percent.

Here is an alphabetical listing of each state performed in the first quarter 2011, according to the RealtyTrac report.