U.S. home prices declined in the first quarter by 2.5% according to the Federal Housing Finance Agency's (FHFA) seasonally adjusted purchase-only house price index (HPI).

The fall marks the largest quarterly decline since the Fourth Quarter of 2008. When compared to the first quarter of 2010, the index fell by 5.5%. This drop conversely corresponds with a 2.8% increase in the prices of other goods and services during the same period.

“House prices in the first quarter declined in most parts of the country,” said FHFA Acting Director Edward J. DeMarco. “In many local real estate markets, particularly those hit hard by this cycle, foreclosures and other distressed properties are still a key factor in recorded and anticipated future sales and may be delaying price stability or recovery. Fortunately, serious delinquency rates also are declining.”

When refinance transactions are included in the index, shows a total decrease in home prices of 2.7% in the first quarter.

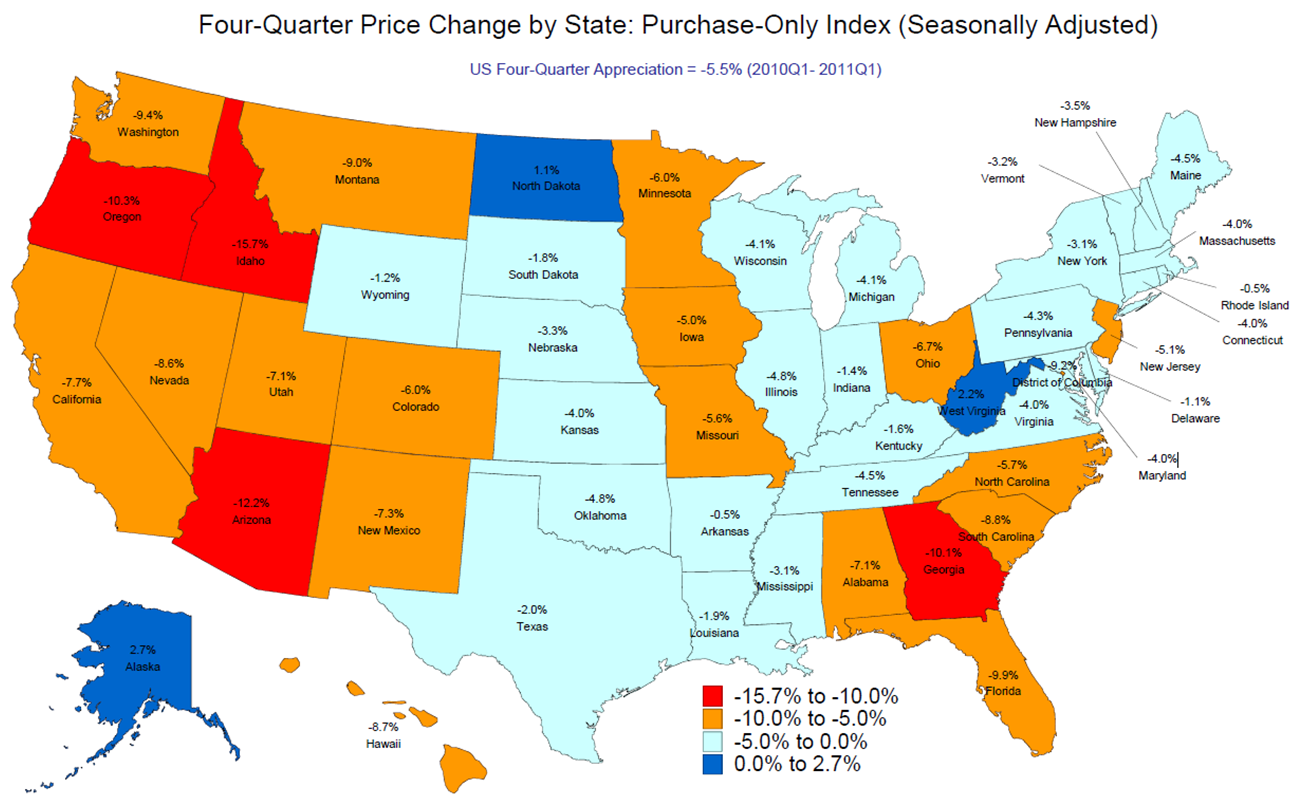

Across the country, only three states have shown positive appreciation in the purchase-only index in the previous four quarters, Alaska (2.7%), West Virginia (2.2%), and North Dakota (1.1%),. States that experienced the biggest drops, ranging from 10$ to 15.7% included Oregon (-10.3%), Georgia (-10.1%), Arizona (-12.2%) and Idaho (-15.7%)