In a survey of 5,000 older Americans aged 50 and over, a AARP Public Policy Institute report found that a majority believe that they may never financially recover from the "Great Recession."

“Many older Americans have been buffeted by skyrocketing health care costs, dwindling home values, shrinking pension and investment portfolios, and employment struggles,” explained John Rother, AARP’s Executive Vice President for Policy, Strategy and International Affairs. “Even if you have a job, this survey demonstrates that you are not immune to the negative effects of the recession.”

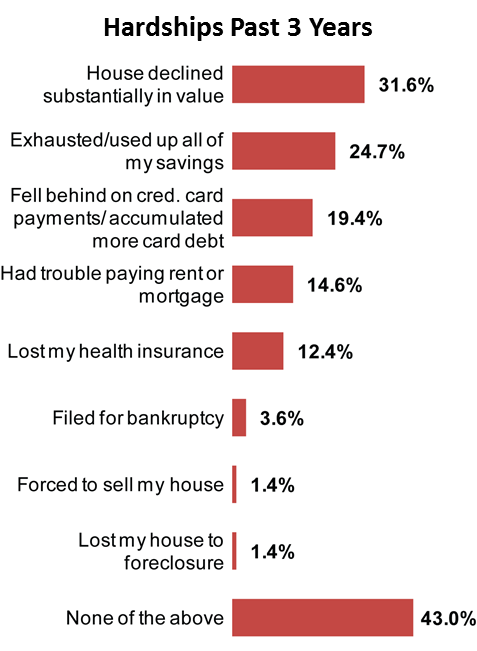

The recession has had a significant impact on respondents. Just under 30% reported that they were either currently unemployed (16.7%) or had been involuntarily unemployed in the previous three years (12.7%). Financial hardship were reported by 57% of those surveyed with the most common hardships being significant loss of home value(31.6%) and exhausting all savings (24.7%). About one half of respondents stated that they had trouble making ends meet during the recession. The most common reasons cited were an increase in household expenses and reduction in income.

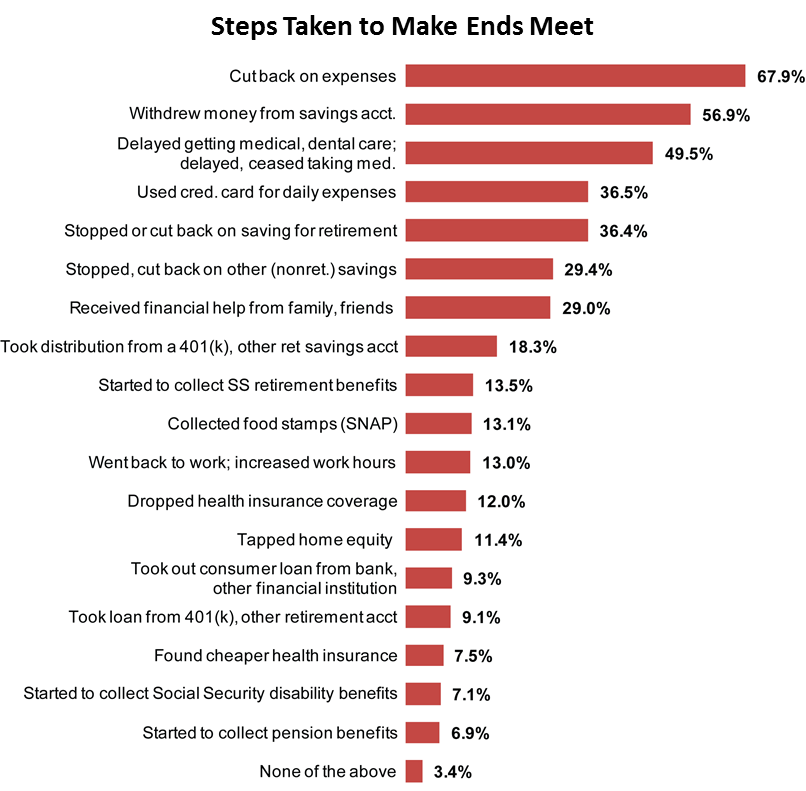

In response to financial difficulties or challenges, a number of ways for making ends meet were reported. Most who faced difficulty making ends meet first sought ways to reduce expenses. Additionally, the most reported methods reported included withdrawing money from savings accounts (56.9%), delaying medical/dental care or ceasing medication (49.5%) and using credit cards for daily expenses (36.5%). Tapping into home equity was cited by 11.4% as a tool used to bridge the income-expense gap.

Over half of the respondents feel less confident about their financial security following the recession and a similar percentage rated their current financial well-being as fair or poor. Additionally, a majority (52.6%) expressed a lack of confidence that they will have sufficient retirement funds to live comfortably throughout retirement.

To help boost retirement accounts, one-third reported increasing contributions to savings an retirement accounts. Many expected that they would continue to work part-time in retirement (44.1%) or would delay retirement (33.4%).

“This unprecedented economic recession has left a legacy of low confidence, lower savings and the lowest employment rates in decades,” concluded Rother. “While we are hopeful about improving economic conditions, this survey reminds us that older Americans will feel the effects of the recession for years to come.”