With data through April, Clear Capital's Home Data Index (HDI) Market Report indicates that home prices have now hit a "double dip," with national prices falling 0.7 percent below prior lows reached in March 2009.

“The latest data through April shows a continued increase in the proportion of distressed sales that are taking hold in markets nationwide,” said Dr. Alex Villacorta, director of research and analytics at Clear Capital. “With more than one-third of national home sales being REO, market prices are being weighed down as many markets have not regained enough footing to withstand the strain of the high proportion of REO sales.

Key findings in the report include:

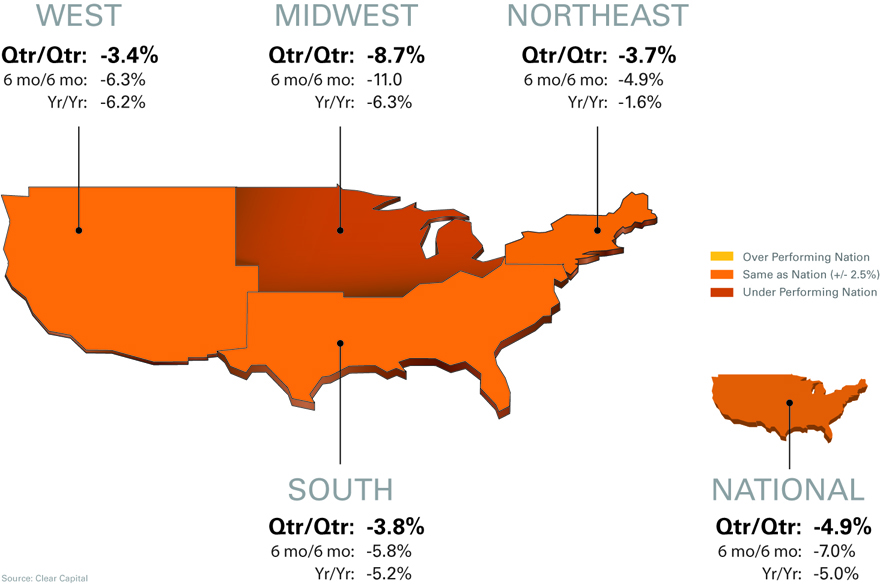

- National quarterly home prices changed -4.9%; while year-over-year national price changes reached -5.0%.

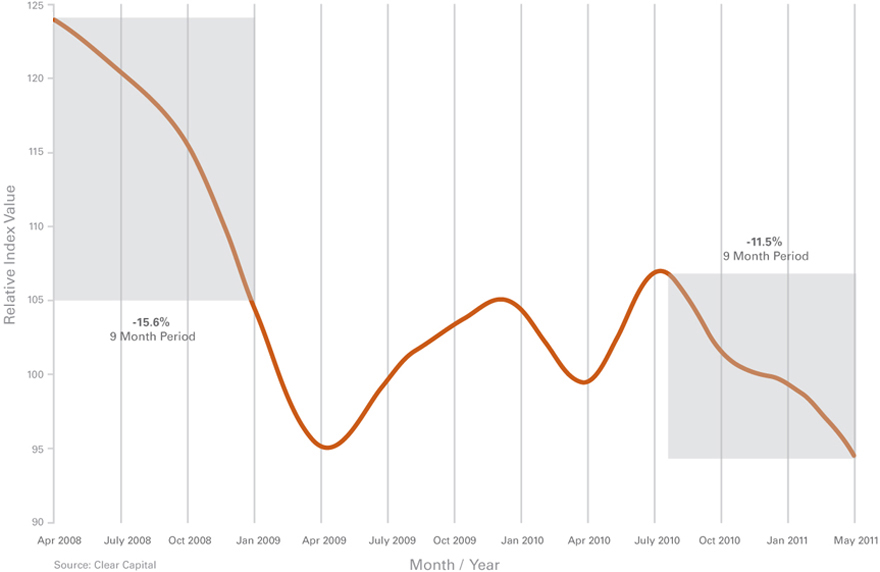

- National home prices have fallen 11.5% over the previous nine-month period, a rate of decline not experienced since 2008.

- In a sign of the continued volatility and fragility of home prices, all the major Metropolitan Statistical Areas (MSA) tracked in this month’s report showed quarter-over-quarter price declines.

- National REO saturation rate reaches 34.5%.

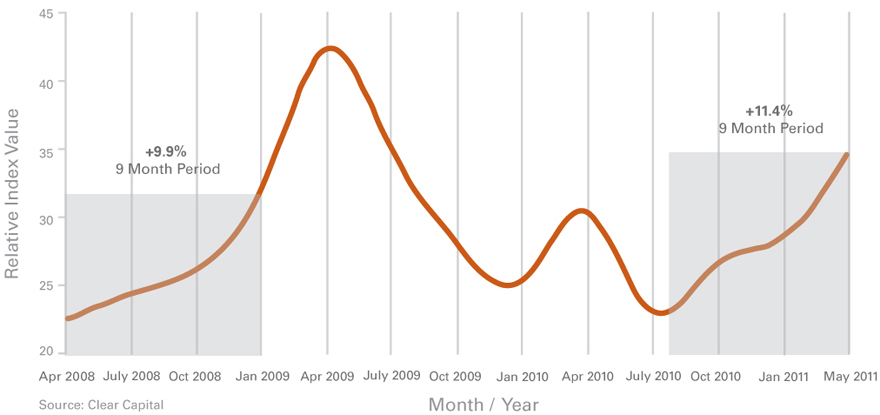

National REO Saturation (2008 to 2011)

The growing trend of the percentage of REO sales in the total sales has mirrored a period in 2008 that led to home prices dropping 15.6 percent in the same period. In the current period, the increase in REO saturation has corresponded with a 11.5 percent decline in home prices.

National Home Price Change (2008 to 2011)

According to the report, the trend from 2008 reversed when new stimulus measures were introduced. Although there are no current stimulus measures for home buying (such as the home buyer tax credit), the bright spot is that home affordability is higher due to lower prices than the fall in 2009. Additionally, the current trend is heading into the traditional home buying season of spring and summer. In 2008 the trend fell into the typically slow season of winter.

National/Four Region Market Overview (April 2010 to May 2011)

The Midwest region, although it performed worse in the previous quarter than the other regions is the only one that has not yet reached double dip lows. The West, on the other hand, which was the first to reach double dip prices last month, is no longer the worst performing region.