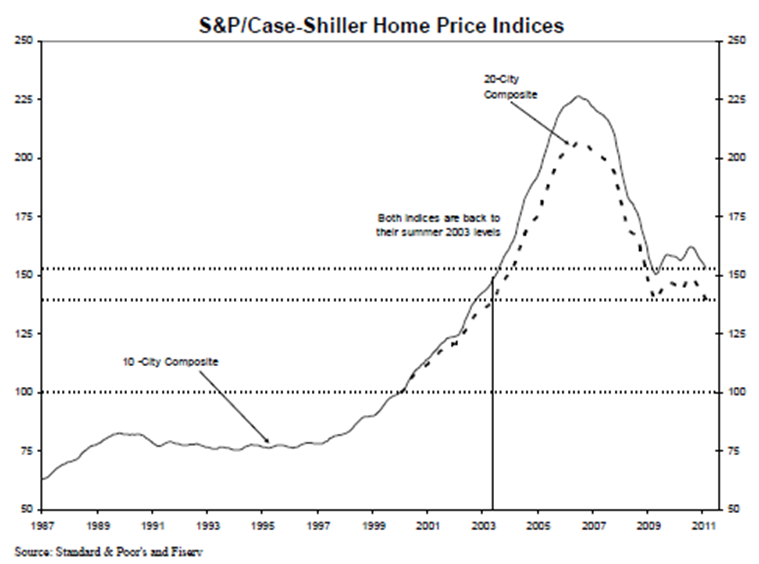

Home prices are edging closer to 2009 lows according to the latest data from the S&P/Case-Shiller Home Price Indices. In the report, the 10-city index fell by 2.6% and the 20-city composite fell by 3.3% when comparing February 2011 to February 2010.

.png)

Washington D.C. was the only market area to post a year-over-year gain, showing an annual growth rate of 2.7%.

“There is very little, if any, good news about housing. Prices continue to weaken, trends in sales and construction are disappointing.” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Ten of the 11 MSAs that recorded index lows in January fell further in February. The one exception, Detroit, is 30% below its 2000 price level. The 20-City Composite is within a hair’s breadth of a double dip. Fourteen MSAs and both Composites have continued to decline month-over-month for more than six consecutive months as of February."

Home prices have settled to levels approximate to the summer of 2003. The 10-city composite is just slightly above the 2009 low point, while the 20-city composite has equaled the low point.

“Recent data on existing-home sales, housing starts, foreclosure activity and employment confirm that we are still in a slow recovery," Blitzer said. "Existing home sales and housing starts rose in March, but remain close to recent lows. Foreclosure activity showed decreases in mortgage delinquencies in the fourth quarter of 2010, but are still close to historic highs."