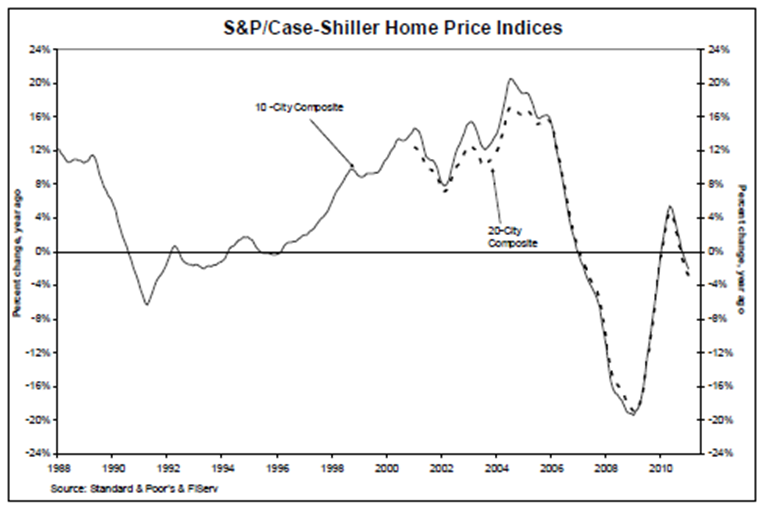

Home prices opened 2011 with further deceleration in the annual growth rates according to the latest data from the S&P/Case-Shiller Home Price Indices. With data compiled through January, the 10-city composite posted a drop of 3.1 percent from January 2010.

According to the data, only two Mesas', San Diego (.01%) and Washington D.C. (3.6%) recorded positive year-over-year changes.

“Keeping with the trends set in late 2010, January brings us weakening home prices with no real hope in sight for the near future” says David M. Blister, Chairman of the Index Committee at Standard & Poor's. “These data confirm what we have seen with recent housing starts and sales reports. The housing market recession is not yet over, and none of the statistics are indicating any form of sustained recovery. At most, we have seen all statistics bounce along their troughs; at worst, the feared double-dip recession may be materializing."

The chart the annual returns for the 10-city and 20-city composites. After reaching a deep trough in 2009, the indices turned positive in early 2010, but are now tending into negative territory. Seventeen of the 20 Mesas' and both composites have now posted more than three consecutive months of negative monthly monthly returns. Eleven Mesas' posted new lows in January from their their 2006/2007 peaks.