The AARP Public Policy Institute published a report on changes to the reverse mortgage product, "How Recent Changes in Reverse Mortgages Impact Older Homeowners." The report concludes that changes to the product have provided borrowers with more choices, but has also made reverse mortgages generally more expensive and more complicated.

Data in the report included a survey of older homeowners who had either took out a reverse mortgage, or had looked into a reverse mortgage but choose not to proceed. The survey, conducted in 2006, found that the most common reason that non-borrowers choose not to apply for the reverse mortgage was high costs (63 percent).

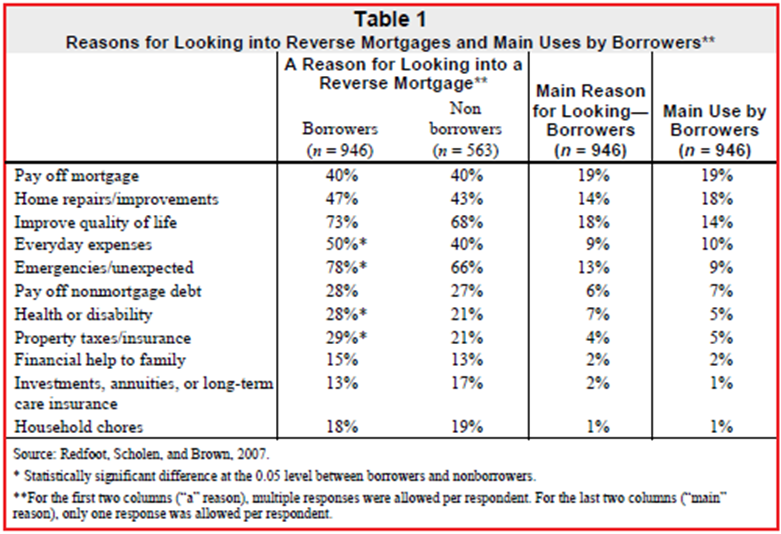

Additionally, the survey examined reasons why respondents looked into a reverse mortgage and compared it to the actual main use by those who choose to take out a reverse mortgage. In an interesting twist, the survey asked respondents two different ways why they had looked into a reverse mortgage, one allowing multiple responses, and the other only allowed single response. The break down is in the chart below.

When allowed multiple responses, the largest percentage of borrowers cited, "Improve quality of life" (73%) and "Emergencies/unexpected" (78%). However, when it came to the actual use of a reverse mortgage, "Paying off mortgage" (19%) and "Home repairs/improvements" (18%) were the most common responses.

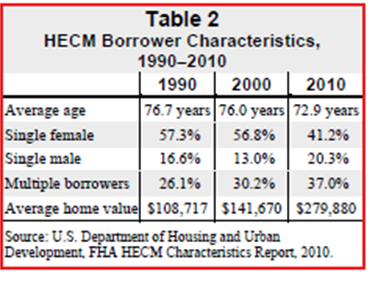

Looking at borrower characteristics, the report points to a trend of the average age of HECM borrowers as cause for concern about the long-term impact of reverse mortgages on financial security. It suggests that this creates problems since the average duration of these loans in six to seven years, but the report does not expound on the issues that are created. Since 1990, the average age of borrowers has fallen from 76.7 years old to 72.9 years old. Couples have also increased significantly from 26.1 percent of borrowers to 37.0 percent in 2010.

Looking at changes to the HECM program, the report noted the transition in the secondary market from Fannie Mae to Ginnie Mae that led to the fixed product becoming the dominant product choice. Pointing to the interest costs, the report suggests that these loans could be much more expensive for borrowers due to the full draw requirements. At the same time, it acknowledges that the fixed often have lower upfront costs and no servicing fees.

In summation, the report calls for additional research and reiterates the concern about recent changes leading to the product being more complicated and more expensive. "While consumers have more product choices, reverse mortgages are generally more expensive and more complicated," the report claims, "leading to more scrutiny from Congress and regulatory agencies charged with protecting consumers."

The odd thing is that the brief report really doesn't provide any substantiation as too why these two claims would be true. It does layout a series of recent changes from the FHA including the reduction of the principal limit, reduction of the upfront mortgage insurance cost, and the introduction of the HECM Saver. This could be construed as reasons why it may be more difficult for some prospective borrowers to understand the current makeup of the product, but there isn't anything that supports why the changes have led to a more expensive product.

It is not clear who the intended audience is for this report, but for older homeowners who may be considering looking into a reverse mortgage and turn to the AARP website for information, this report could serve to provide more confusion than meaningful information.