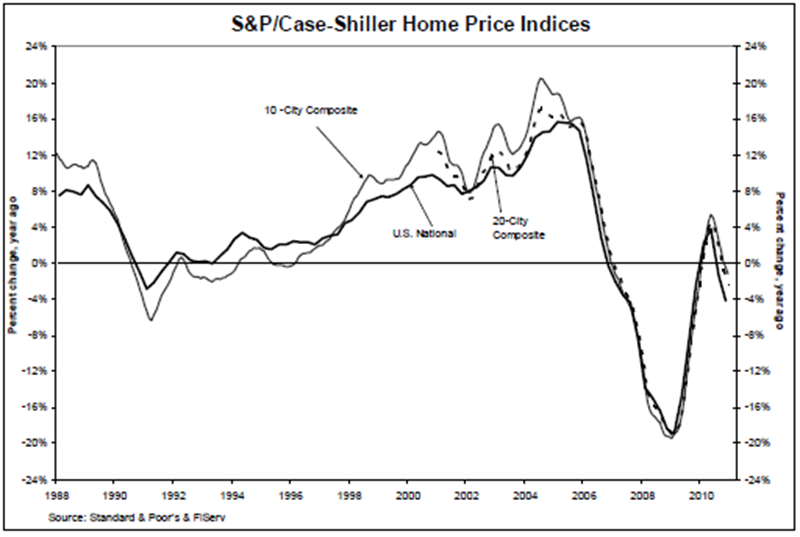

Incorporating data through December of 2010, the latest S&P/Case-Shiller Home Price Indices indicate that home prices declined by 3.9% in the fourth quarter of 2010, and by 4.1% when compared to the final quarter of 2009.

Declines were reported in 18 of the 20 MSAs covered by the indices. According to David M. Blitzer, Chairman of the Index Committee, the National Index is now within one percentage point of the low established in the first quart of 2009. Although California did see some gains as Los Angeles, San Diego and San Francisco bounced up from their lows, 11 markets hit their lowest levels since home prices peaked in 2006 & 2007. Those markets included: Atlanta, Charlotte, Chicago, Detroit, Las Vegas, Miami, New York, Phoenix, Portland (OR), Seattle and Tampa.

Across the country, average home prices were at levels similar to those during the first quarter of 2003, and have fell to match a trough reached in first quarter 2009. Of the 20 MSAs covered in the report, only San Diego and Washington D.C. reported positive year-over-year growth rates at 1.7% and 4.1%, respectively.