Class-A property managers are finding it difficult to hold onto their residents. According to an article by RealPage Chief Economist Greg Willet, 52.6% of Class-A renters move after their lease is up, as opposed to Class-B renters who opt to stay in their units 51.1% of the time. Willet says that though this split doesn't look significant, it actually has a big effect on Class-A properties' bottom lines.

Here's more from Willet:

While a difference of 370 basis points between Class-A and B apartments in propensity to renew expiring leases may not immediately register as a big deal, it actually means that Class A operators lose significant revenue for vacant days between leases and spend notably for marketing costs and unit make-ready prep. In the nation’s top 50 markets, Class A operators had to lease about 111,000 more apartments than would have been required if resident retention ran at the same level seen for Class-B properties.

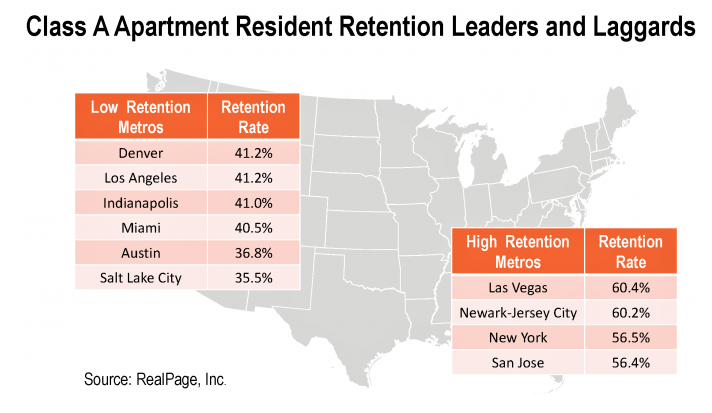

The main factor in retention rates is inventory, according to Willet. Metros that have chronic housing shortages (think New York, Las Vegas, etc.) typically have the best retention rates as renters cling to their units knowing they're hard to come by.

Again, from Willet:

To some degree, the stats posted across metros back up the idea that more construction yields a bump in resident turnover in Class-A properties. Actually, what the stats show is that the absence of construction helps limit turnover. The 20 or so metros that register Class-A product resident retention meaningfully above the national average are markets where the recent inventory growth pace has been comparatively restrained.

Other factors include affordability of single-family homes in the area and demographic differences. Check out the graph below to see the leaders and laggards in Class-A resident retention.

(Courtesy of RealPage)