The U.S. multifamily rent average climbed $4 in April, moving from $1,373 to $1,377 according to a survey of 121 markets by Yardi-Matrix.

More than just the typical seasonal bump in spring and summer, the growth reflects a $10 increase in the last two months, a 2.4% year-over-year gain, which is the highest since last spring.

"The healthy seasonal gains are a good sign that rent growth will remain resilient despite the headwinds faced by the market, particularly the peaking supply pipeline that has produced deceleration in some metros," the report said.

Orlando, Florida, Sacramento, Las Vegas, Tampa, Phoenix were this months’ rent growth leaders ranging from 4% to 6% growth YoY.

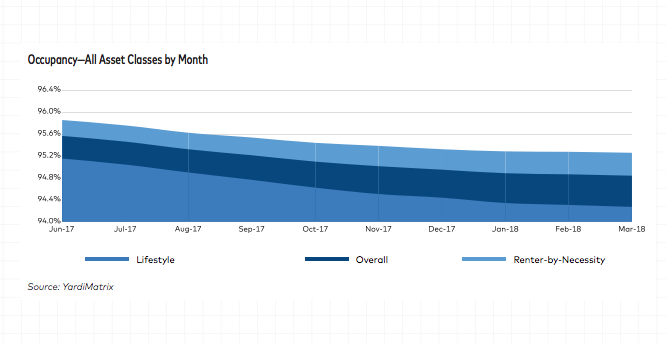

Strong rent growth leads to concerns about the ability of the market to maintain its high occupancy rate (hovering around 95%). Yardi-Matrix’s report indicates there is a direct relationship between rising rents and softening occupancies (see graph below).

(Courtesy of Yardi-Matrix)

According to the report, occupancy rates on stabilized properties dropped 100 basis points YoY. The drop for all multifamily property types is 80 basis points YoY.