In March 2017, the Sarasota Herald-Tribune published an article entitled "7 reasons Sarasota is (still) best place to live in Florida." Though it may have sounded more like hometown boosterism than homeownership, the list began with weather and was followed by beaches, restaurants, arts, parks, and then activities. Celebrity sightings completed the list, with novelist Stephen King, reality TV's Jerry Springer, and original Allman Brothers guitarist Dickey Betts were among the cited.

Beyond the visitors' bureau focus, however, the Sarasota metro area runs on a solid economic engine. That includes the promise of measured real estate appreciation over the next 12 months according to the current VeroFORECAST from Veros Real Estate Solutions. Released in March 2018, the VeroFORECAST report predicts that property values in the Sarasota-Bradenton-Venice Metropolitan Statistical Area will appreciate at a rate of 5.6% through March 1, 2019.

The Sarasota market has a modest supply of homes at 4.5 months, which means slightly better availability than the national average, which according to National Association of Realtors data released last month, was 3.6 months in March 2018, about what it was a year earlier. During the past 12 months it had hovered between 3.2 and 4.3 months.

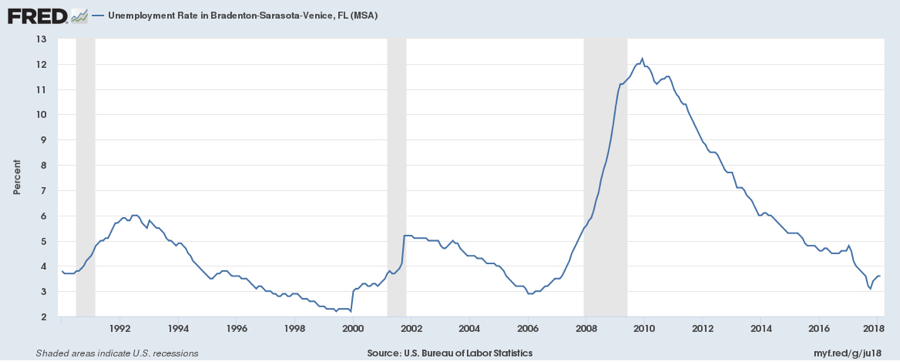

The unemployment rate in the MSA is also lower than the current nation average of 4.1% (as of this writing). Unemployment in the Sarasota-Bradenton-Venice MSA is currently at 3.6%, after a high in 2010 of more than 12%. It soared to that rate from approximately 3% in 2006, an ascent that began before the financial crisis but began steadily easing over the past eight year, see the chart below for more.

(Click to enlarge)

Another reason this market is expected to experience good appreciation over the next year is the healthy 10% population growth it has had over the last decade.

The property appreciation projections within the March 2018 VeroFORECAST covered 342 U.S. metro areas, with all but 10 showing some appreciation in value – topping out by more than 11% in the Seattle metro area. The MSAs covered by the report include nearly 1,000 counties and more than 13,600 ZIP codes. The SFRs, condos and townhouses in these markets house more than 80% of the U.S. population. Sarasota-Bradenton-Venice, which is comprised of Sarasota and Manatee Counties, ranks 114 out of the 342.

As I have outlined in previously weekly columns for HousingWire, Veros Real Estate Solutions creates the VeroFORECAST at the end of each quarter. Presented to subscribers as full Metro Market or Custom County reports, data is broken down month-by-month over one-year, 18-month, and two-year horizons, or at the individual property level via the company’s top performing VeroVALUE AVMs and VeroPRECISION reports.

Using comprehensive historic data from our proprietary VeroHPI, or Housing Price Index platform, that goes back 14 years, VeroFORECAST simultaneously looks forward and backwards in time.

Coincidentally, the projected appreciation of property values isn't separate from tourism. In Sarasota County's May 2017 "Situational Report" on its Housing Affordability Initiative, it referenced a 2015 newspaper article that used data from

HomeAway, an online service for homeowners who rent to vacationers, stating, “Sarasota’s vacation rental listings are up 46 percent in the past five years, and traveler demand for the market is up 63 percent in that time.” Average monthly rates were then approximately $4,800.