Home prices are still on the rise, increasing once again in February, according to the latest monthly House Price Index from the Federal Housing Finance Agency.

Home prices increased 0.6% from January, the report showed. This is a slight slowdown from the 0.8% increase in January, which was revised upward to 0.9%. Annually, home prices increased 7.2% from February 2017.

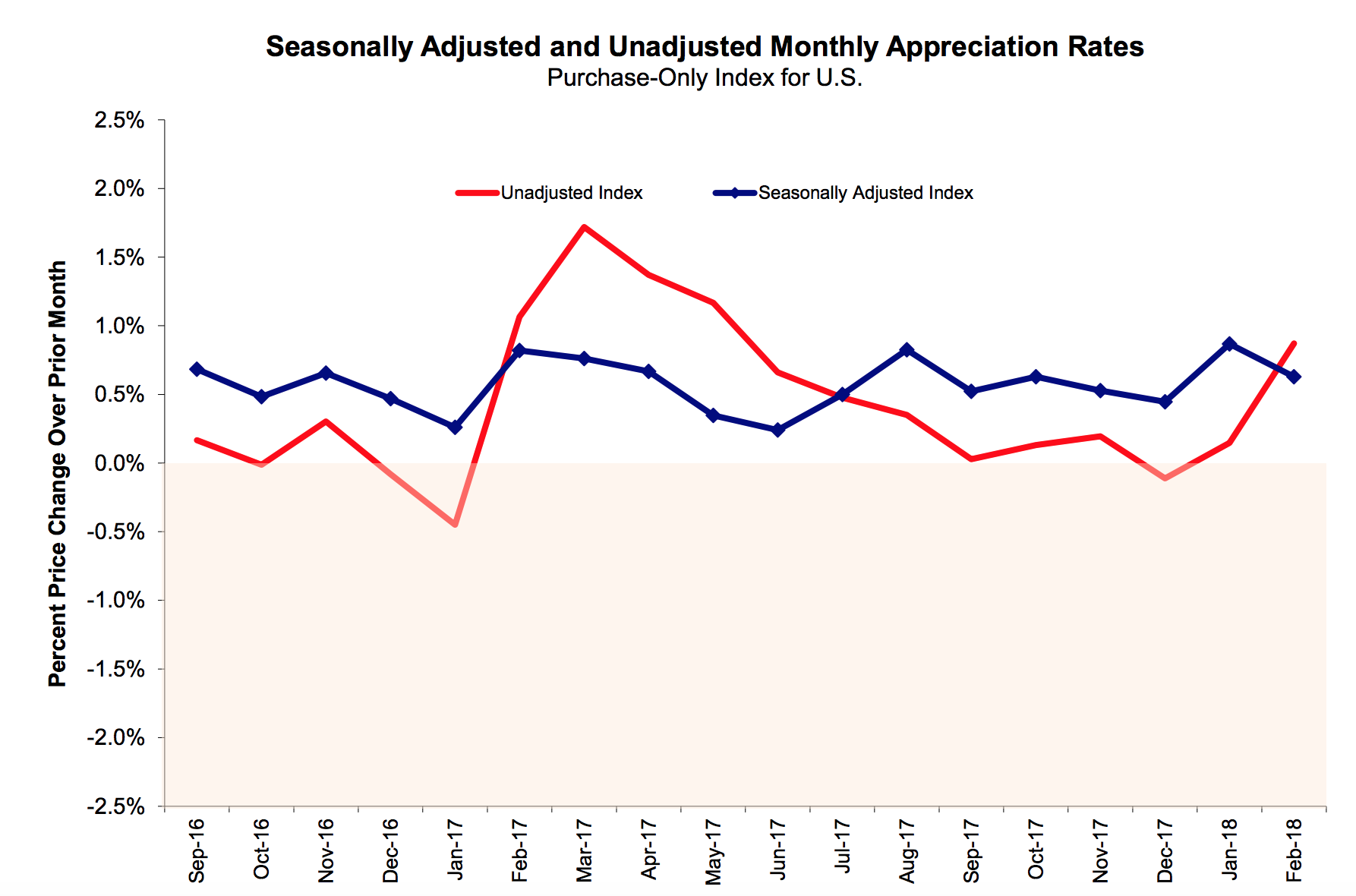

The chart below shows home prices continue to increase each month, but March came down slightly from January’s nearly one-year high.

Click to Enlarge

(Source: FHFA)

The FHFA monthly HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. Because of this, the selection excludes high-end homes bought with jumbo loans or cash sales.

However, one expert explained home prices could begin to moderate in 2018.

“Annual house price growth on both the Case-Shiller and FHFA measures has been fairly stable since the start of the year,” Capital Economics Property Economist Matthew Pointon said. “After dropping for the first time in 18-months in January, growth on the national Case-Shiller index returned to 6.3% in February.”

“A rise in debt-to-income ratios looks to have supported house price gains over the past few months but, with mortgage interest rates now on the rise, we still expect a slight moderation in growth this year,” Pointon said.

Monthly, across the nine census divisions, home price changes from January to February ranged from an increase of 0.1% in the West North Central division to an increase of 1.6% in the East South Central division.

Annually, the home price changes ranged from a low of a 4.8% increase in the Middle Atlantic division to an increase of 10.3% in the Pacific division.

Here are the states in each of the divisions:

West North Central: North Dakota, South Dakota, Minnesota, Nebraska, Iowa, Kansas and Missouri

East South Central: Kentucky, Tennessee, Mississippi and Alabama

Middle Atlantic: New York, New Jersey and Pennsylvania

Pacific: Hawaii, Alaska, Washington, Oregon and California