The Federal Reserve Bank of New York runs a blog called Liberty Street Economics and it is generally filled with economic data hit points.

The economists there cover it all, finance-wise: student loans, inflation, cyber currencies, online shopping habits.

And once in a while they touch on issues impacting loan officers. Yesterday they posted one such piece of content.

The Fed 2018 housing survey, which reflects both homeowner and renter (potential homeowner) economic views, was released yesterday and notes several changes in the past year that are impacting homeownership perceptions.

The survey, among other things, collects data on households’ perceptions and expectations for home price growth, intentions regarding moving and buying in the future, and access to credit.

For homeowners, it collects detailed information on their mortgage debt, past actions and experiences — such as foreclosure or refinancing—and expectations regarding future actions — such as taking out new debt or investing in the home.

For renters, the survey elicits preferences for owning and perceptions regarding the ease of obtaining a mortgage.

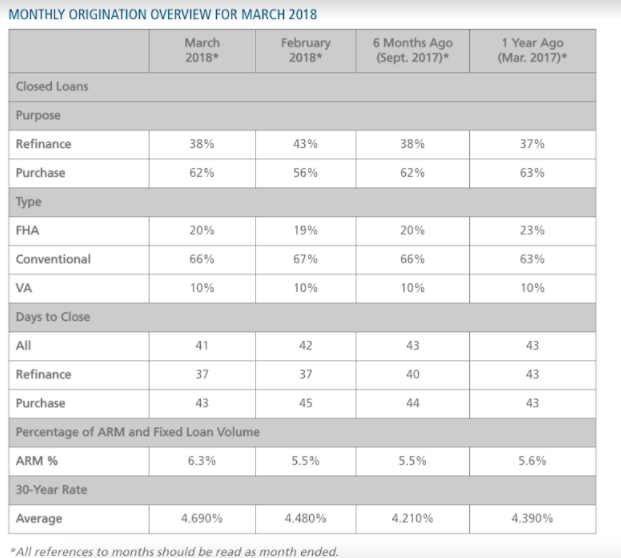

It is true that rates are rising, loan profits are down, credit feels tight and refinances are dipping. But, the good news is that the perception of homeownership as a good investment is on the rise.

Here is that chart showing the growing, positive sentiment:

The bad news is there are regional variations, be sure to check the survey for your metro area.

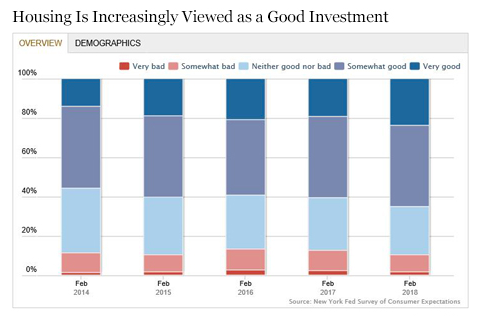

In other good news, the most-recent Ellie Mae origination report was a net positive for mortgage lending. The report shows the purchase market for homes is continuing to gain momentum. The percentage of closed purchase loans increased to 62% of total closed loans, up 6% from the month prior – despite the continuously rising 30-year interest rates.

Plus mortgages are closing faster, as per Jonathan Corr, president and CEO of Ellie Mae: “As we’ve seen in the past several months, the shift to a purchase market coupled with the adoption of digital mortgage solutions by our customers aids in driving down the time to close.”

Here a chart reflecting the entire landscape of mortgage lending from Ellie Mae: