These days we are all reimagining the mortgage lending experience!

Sound familiar?

In Q1 of 2016, few were talking about it, but a lot of lenders are talking about it now. Which is great because it means the industry is well on its way to evolving to the "here and now" mentality, instead of the "there and then." However, very few truly understand what that phrase means.

If you had to, could you do an “elevator pitch” type of explanation of how your company is doing that? Could you present that vision to your customers? To your referral partners? Are you talking about your new mortgage app, or your new digital mortgage app, going paperless, or portals? A lot are, which is why I believe they are completely missing the point.

When we talk about experience, we should be talking about the experience (i.e. the customer journey). We should be designing a complete digital retail mortgage process that is founded on standard CX (Consumer Experience) principles. Right now experience isn’t even on the radar for a majority of the lenders. Yes, more and more are jumping into the digital waters, but that is focused on UX/UI (user experience/user interface). I am talking about a true CX methodology, that Brian Solis refers to as Experience Architecture.

Did I lose you yet? I know, I know, you are reading all these terms like CX, UI, UX and now I'm throwing Experience Architecture into the mix? You might be saying, "What the H.E. double hockey sticks are you talking about!". Stay with me, because this is where it all comes together. CX is about the entire customer journey. It is the experience before our clients are even our clients. It is how they find us, how we reach out, how we nurture, how we communicate, trust, knowledge, and delivery. It starts with perception, with tapping into the emotion of the consumer with the service we are providing. We need to understand that we are lucky to be in one of the few industries that help consumers achieve their dreams.

Think about that. Helping someone achieve their dreams. That is a powerful emotion to tap into. Owning a home for most of our clients is a dream come true. People don’t dream about owning a pair of Nikes. They don’t dream about owning a music album, or about owning an iPad, or a car (well maybe a '68 442). Yes, I am sure they want those things, but I am talking about real dreams. I am talking about the kid who grew up in a crappy apartment and always dreamt of having a house. It’s about the single mom or dad who wants to provide a HOME for their kids. The people that want the "white picket fence" feels. The parents that want to put down roots for their family to be a part of a community. I am talking about the connection on an emotional level.

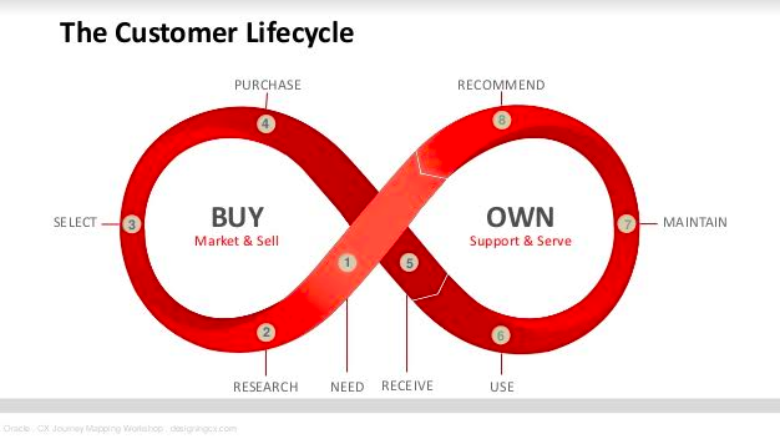

Look, the mortgage process can, for lack of a better phrase, suck. It can be illogical, frustrating, and downright painful. It doesn't help that there are still lenders out there that only see their clients as $$$ signs as opposed to humans. They care about short-term gains as opposed to long-term brand growth. This business needs to be about building generational relationships. Providing a mortgage for parents, their kids, their grandkids, grandparents, all of them. There is a reason that Oracle's Customer Experience map is an infinite loop:

This starts by creating a whole new customer journey and not just improving the current process. The traditional process itself is based on the days of the mechanical assembly line model as opposed to the social connectivity era we live in now. No buckets or silos to where the consumer fits a profile of "need mortgage, get mortgage." But instead, a consumer experience that matches those from all walks of life as individuals. If you look around, this is the type of business disruptors are doing (across all industries), and this is why they are winning.