As home prices, and therefore homeowner equity rises, consumers who wish to take out a home equity line of credit are expected to double over the next five years, according to a new report from J.D. Power, and lenders need to be ready.

HELOCs are projected to double to 10 million in the next five years, and in order to prepare for this and capitalize on the trend, the report explained lenders will need to increase their digital offerings.

In fact, the digital experience is becoming increasingly critical to customer satisfaction, according to the new J.D. Power 2018 U.S. Home Equity Line of Credit Satisfaction Study.

The study looks at customer perceptions of the HELOC process and explores the key variables that influence customer choice, satisfaction and loyalty based on six factors including offerings and terms, application/approval process, closing, interaction with the lender, billing and payment and post-closing and usage.

“Lenders need to recognize that the HELOC customer experience is a journey that begins with initial consideration and evaluation and extends through to usage, with each part of the journey affecting overall perceptions,” said Craig Martin, J.D. Power senior director of financial services.

“Increasingly, many steps in that process are occurring in digital and mobile channels, which are areas that the industry has been slow to leverage and refine,” Martin said. “As Millennial homeownership rates increase and home values continue to rise, lenders need to be able to meet these customers where they want to be, not try to force them into the lender’s entrenched methods.”

The survey found that the younger generation especially expected more digital offerings from their lender. While 66% of all borrowers gathering information and HELOCs did it in person, 59% of Millennials gathered their information from a desktop and 50% through mobile platforms.

About 88% of HELOC borrowers answered that they began searching for a HELOC without being prompted by their lender. Lenders were even less likely to be marketed the product from their lender as 94% began the search on their own.

And as they began looking for a HELOC product, 55% of borrowers compared at least one other lender during the shopping process. Millennials were the most likely generation to shop around as 80% indicated they explored at least one other lender.

However, about 64% of borrowers said they had some type of concern about obtaining a HELOC product. Once again, Millennials held the highest percentage as only 13% of the younger generation said they didn’t have any concerns. Some of the key concerns borrowers cited include the variable nature of the loan and overextending themselves.

“Steadily rising home prices, rising equity in the home and growing competition among lenders creates an opportunity for homeowners to tap into a low-cost source of funds,” Martin said. “The findings in this study are not only instructive to lenders on how to better tailor their customer offerings and processes to create a better experience, but they also provide a valuable guide to consumers on what to look for when shopping and applying for a HELOC product and choosing a partner for their borrowing needs.”

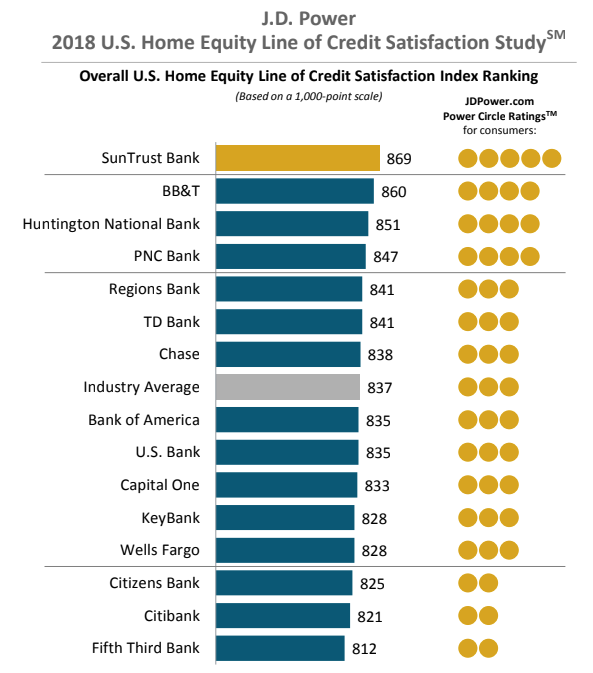

The chart below shows which banks scored the highest in consumer satisfaction for their home equity line of credit. SunTrust Bank took first place with a total 869 points on a 1,000 point scale.

Click to Enlarge

(Source: J.D. Power)