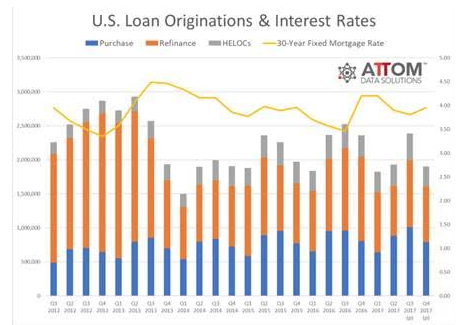

Mortgage originations plummeted in the fourth quarter of 2017 due to a sudden drop in refinances, according to the Q4 2017 U.S. Residential Property Loan Origination Report from ATTOM Data Solutions, a property database.

More than 1.9 million total residential mortgages were originated in the fourth quarter of 2017, down 20% from the third quarter and down 19% from last year, the report showed.

This drop is mainly due to a decrease in residential loans originated in the fourth quarter. Refis dropped 17% from the third quarter and 34% from the year before to 818,158 originations in the fourth quarter.

Purchase loans also decreased, falling 22% from the third quarter but just 1% from the year before to 791,637 originations in the fourth quarter. Home equity lines of credit decreased 25% from the third quarter, falling from its nine-year high, and 7% from last year to 293,570 originations in the fourth quarter.

“The falloff in refinance originations continued for the third straight quarter, but purchase originations held steady compared to a year ago despite ballooning down payment amounts that make it more difficult for first-time homebuyers to compete, as evidenced by the three-year low in the share of FHA buyers,” ATTOM Senior Vice President Daren Blomquist said.

“And while the rise in construction loans in part reflects homeowners reconstructing in the wake of hurricane Harvey in southeast Texas, the widespread rise in construction loans in other parts of the country indicates that more homeowners are staying put and remodeling rather than trying to move up into another home that comes with a big down payment and probably a higher mortgage interest rate,” Blomquist said.

The chart below shows the number of mortgage originations each quarter dating back to 2012, broken down by purchase, refinance and HELOCs.

Click to Enlarge

(Source: ATTOM)

The loan origination report is derived from publicly recorded mortgages and deeds of trust collected by ATTOM in more than 1,700 counties accounting for more than 87% of the U.S. population. Counts and dollar volumes for the two most recent quarters are projected based on available data at the time of the report.

Other notable trends the report found includes the median down payment on single-family homes and condos, which decreased from the record high of $19,100 in the previous quarter to $18,000 in the fourth quarter. However, this is up 20% from $14,950 in the fourth quarter of 2016. This represents a down payment of 7.1% on a median priced home.