At my mortgage company, I create a lot of our CRM content. I do this because I hate the canned messages that don't add any value to the consumer and sets a monochromatic tone. Two things I 100% believe in is not running away from the perception of our industry and setting expectations. Because of that belief, I set the tone right from the start with our initial welcome email talking about how the mortgage process can "seem" frustrating and complicated.

Why do I do this? For three reasons.

- Consumers have a crappy perception of our industry as a whole

- Google isn't going anywhere

- Over 90% start their home buying journey online

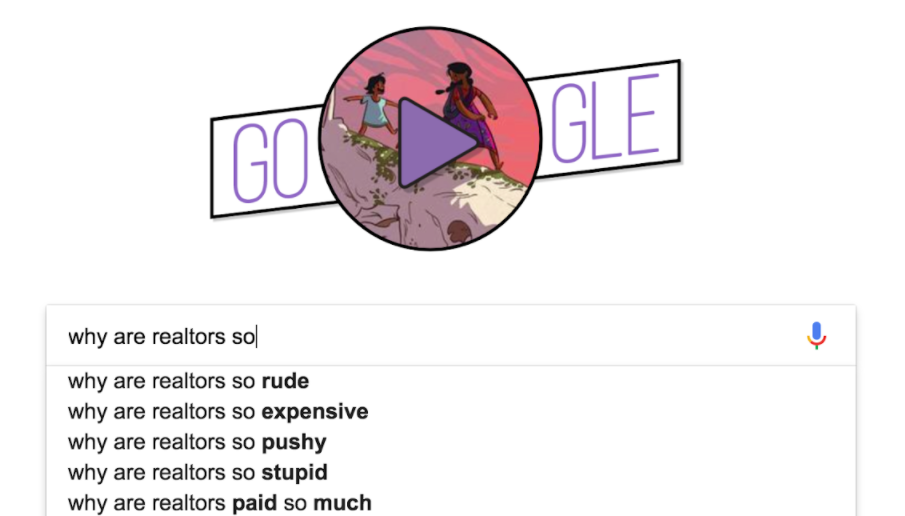

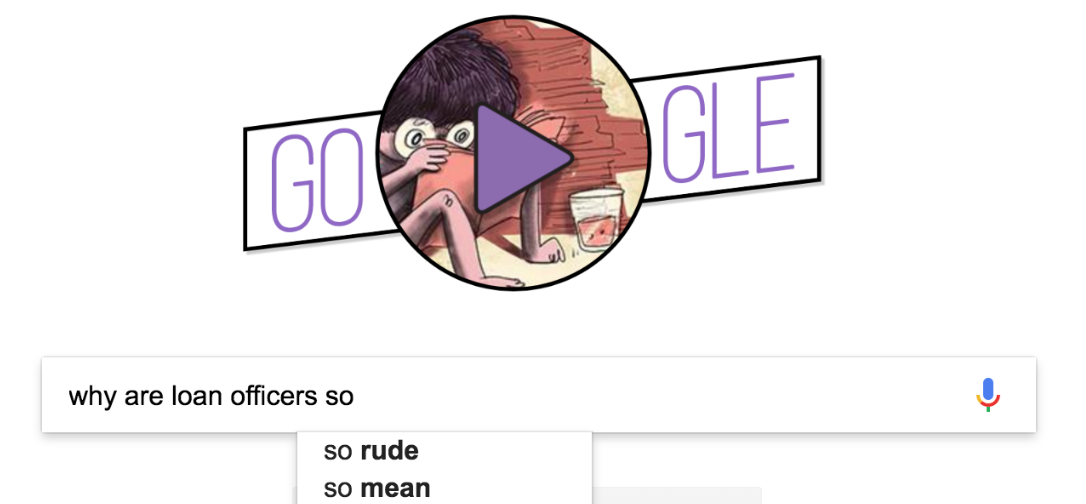

Why is this important? One word; Perception. Look below for what people are searching for as it relates to our industry and then you tell me we don't have a huge perception problem.

Google is a search tool (for those living in a cave) that will autofill search requests based on the most-searched, related items.

Look what most people are asking Google about loan officers and Realtors:

Again, the reason these phrases pop up in Google's autocomplete is that they are most popular. What you are seeing what consumers are searching for when it relates to us. Let that sink in.

Now, getting back to my welcome email. After that first sentence or two that acknowledges what the consumer already knows/thinks, I go into what we are going to do as a Loan Officer, as a Mortgage company to make this a stress free experience for them. The next part of the email is going into setting expectations on how, as a consumer, they can work with us to make this a slam dunk for them. So I have successfully addressed perception and set expectations.

Look, we all know that bombs can go off during a mortgage transaction for various reasons. When you don't set expectations at the start, you are passing on your one chance to defuse the bomb before it goes off. Why would you take that risk? Are you doing it just to avoid a tough conversation up front? The one thing to know is that there is ZERO risk in preparing your client. Zero.

I recently I had a Loan Officer challenge me on this saying asking me "Why would we want to mention that the process could be frustrating or complex. We don't want to give them a negative perception of the process." I showed him the google searches, explained to him as I have above and simply said: "You tell me if you think it is better to hide from the perception or change it. If we change their perception by exceeding their expectations what chance do you think we have of retaining them as a client long-term and gaining referral business?" that ended the discussion.

I have a passion for the Real Estate and Mortgage industry. I grew up in this industry. There is no greater fan of those that work hard to put people into homes, than me. We are in one of the rare positions of being a business where at the end of the transaction we are helping our clients achieve their dreams. Let that sink in as well. There has never been a more critical time to be great at what we do, serve our clients, and give them a great experience. Don't run away from their perception, instead shatter it by making them into a raving fan of what you do.